Start your brokerage with a fully-supported, high-quality trading platform that saves you both time and costs.

About Spotware

Spotware is an international technology provider, successfully delivering complex fintech industry solutions for over 14 years. Comprising 100+ employees from 8 different countries, and boasting a sophisticated network of brokers, traders and partners, we consider the Spotware family our greatest asset of all, rewarding initiative and cherishing cooperation.

14+

years of fintech innovation

250+

clients

100+

in-house developers

4M+

traders

Complete solution for brokers

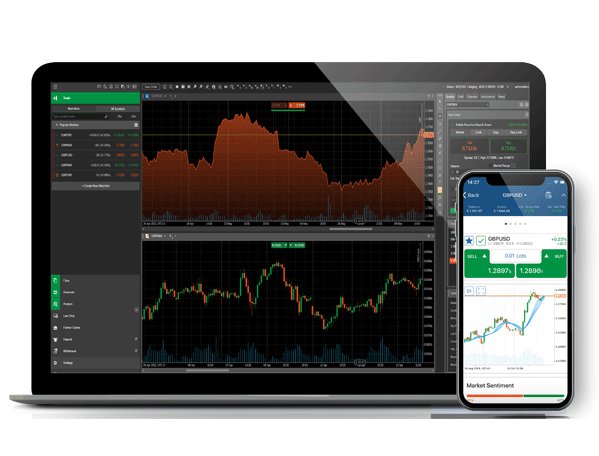

The cTrader suite is a complete turnkey solution for brokers, large or small. All the technology needed to offer premium forex, CFD and spread-betting services is now available from one vendor.

Charting

Admin

panel

IB programme

Reach millions of traders

cTrader is trusted by millions of traders worldwide and supported by a

large community of partners. Together, we help brokers grow.

Introducing brokers

cTrader offers a versatile IB programme with unlimited multi-level revenue sharing.

Strategy providers

Thousands of strategy providers who proactively hunt for new traders to invest in their strategy.

Algo developers

Tens of thousands of developers who specialise in robots, indicators and tools for cTrader.

Community

A strong community of advocates who back cTrader with 10,000+ engaged members.

Superior technology

Full proprietary technology stack, custom communication protocols, enterprise-grade hardware, global points of presence, ultra-low latency networking, native application layer and cross-connects with liquidity providers. All these allow us to deliver quotes to clients and execute orders faster than anyone in the industry.

$40M+

invested in infrastructure

99,99999%

average uptime

3 ms

internal processing time

Start your brokerage with a fully-supported, high-quality trading platform that saves you both – time and costs.

Try cTrader

Try cTrader and open your own demo or live account.

cTrader for Windows

Includes Trade, Copy & Algo for Windows 7, 8, 10 & 11

Mac

Includes Trade, Copy & Algo for macOS 10.15 & up

cTrader Web

Includes Trade & Copy for any popular browser

Google Play

Includes Trade & Copy

App Store

Includes Trade & Copy

Amazon Appstore

Includes Trade & Copy

cTrader APK

Includes Trade & Copy

Huawei AppGallery

Includes Trade & Copy

Samsung Galaxy Store

Includes Trade & Copy

Brand value

cTrader offers brokers global market recognition and helps them gain their share among traders with a premium trading platform. By sharing our Traders First™ approach, brokers can boost their credibility and show commitment to their clients. They also align themselves with dozens of leading brokers who already offer cTrader. This added value attracts traders and serves the long-term goals of brokers, hence benefiting all market participants.

Acquire global market recognition of a credible and trustworthy brand and earn trust of traders worldwide.

Client testimonials

Yiannos Xenophontos

Chief Dealer,

FxPro Financial Services Ltd.

As the first broker to offer cTrader, we have witnessed countless updates over the years. All of these have helped us scale with cTrader – the platform of choice for many of our customers today. Thankfully, cTrader…

Ilan Azbel

CEO,

Autochartist

Having an active and stable integration with cTrader has been a great advantage for us. It’s a popular platform, in which broker interest is growing by the day. It supports our wide range of languages and regular updates of research. Most importantly, it’s available out-of-the-box, so we can be certain of an efficient deployment for our customers.

Michael Turck

Global Head of Liquidity and Sales, Tradeview Markets

Tradeview Markets cTrader suite was delivered in 6 days. It was an effortless process for us to set up and configure. Over the past 12 months, we have been impressed with the level of support and speed of troubleshooting assistance we have received, even while operating in a totally different time zone. This allows us to help our clients faster and reflects great on us.