Introduction

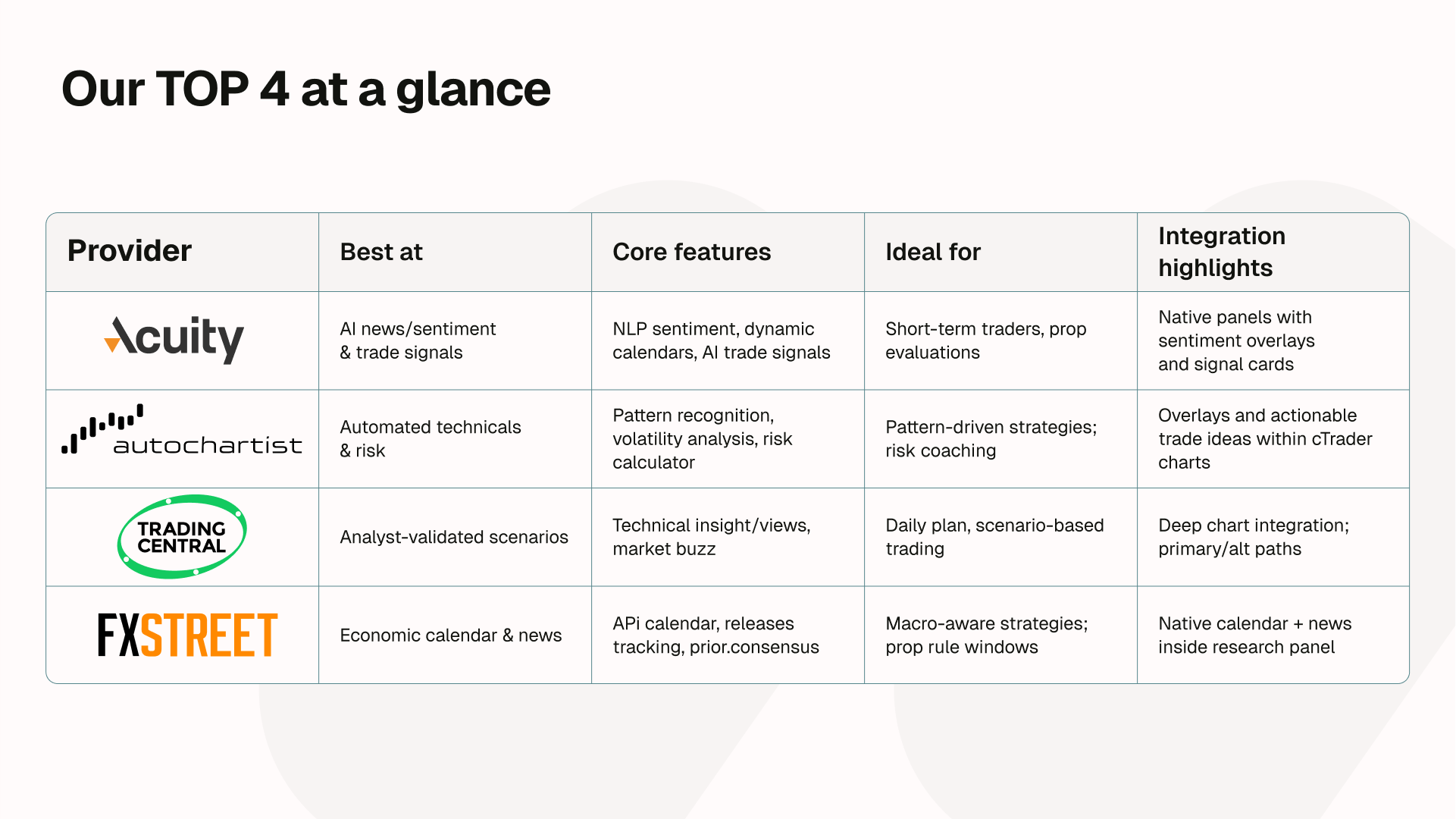

Investors and traders today are spoilt for choice. Yes, they want attractive spreads and leverage, but today’s competition is also defined by credibility and user experience. Traders expect high-quality signals, timely news, and explainers that increase confidence in their next click. The firms that deliver this experience inside the trading platform keep users engaged longer and lift monetisation per account. This article walks through the four top third-party integrations available in cTrader: Acuity, Autochartist, Trading Central, and FXStreet, and why cTrader’s open, plugin-friendly architecture allows brokers and props to deploy them quickly and at scale.

Want a tailored integration plan? Contact our sales team.

Why do integrations matter for brokers and prop firms?

Sustained retention needs content. Pricing alone is no longer enough. When traders find explainable signals, contextual news, and hands-on tools right where they trade, platform stickiness rises and random trading declines. In practical terms, that means fewer abandonment points, more meaningful trading activity, and a stronger brand posture around education and risk management. Industry providers now publish playbooks and case studies oriented around engagement lift and content-driven retention, and partners increasingly expect the platform to surface these natively.

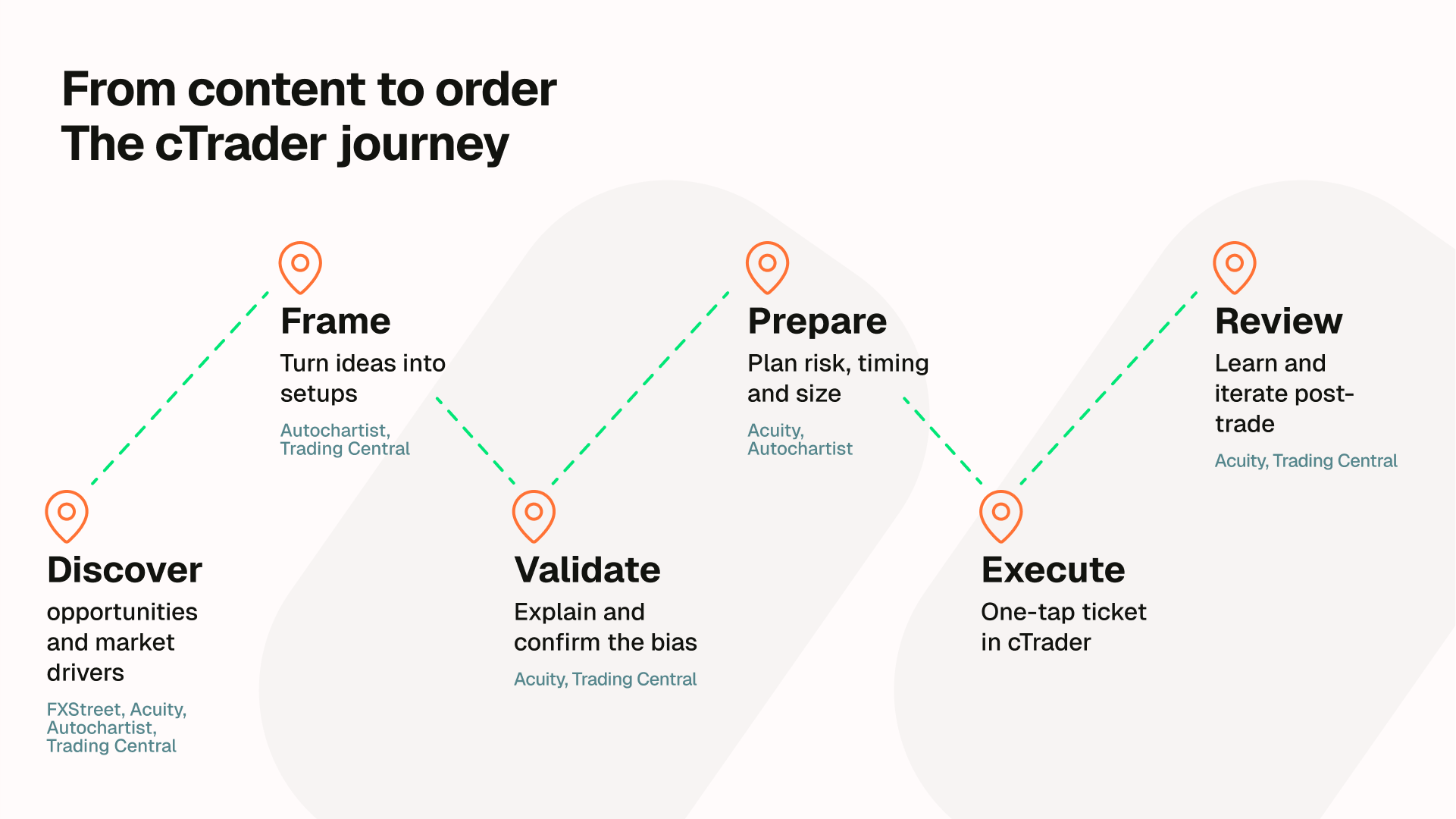

Prop firms have an even more apparent reason: funding decisions and evaluation phases benefit from consistent, objective guidance so traders don’t improvise their way into violations. Inside cTrader, structured trade-idea cards and risk overlays guide behaviour toward rules-aligned, data-driven execution, which reduces support tickets over time. Example: a two-step evaluation enables Acuity’s sentiment/event panels and Autochartist’s risk-sized setups in the Active Symbol Panel. Candidates scan the idea, see the pre-framed SL/TP and position guidance, and place the order from the same workspace. Results: fewer rule breaks, such as oversizing or trading during restricted events, cleaner audit trails for payouts, and a lower volume of “why was I failed?” disputes, because both the trade and the insights that informed it are live inside the platform. In short, cTrader’s APIs and plugin model enable you to deliver education and analytics at the point of decision, not as after-the-fact content.

Spotlight on the top 4 integrations

Features surface only if the broker enables the service for that brand/account (common across Spotware integrations).

Acuity - anchor your news, sentiment, and event layer in cTrader

Acuity delivers NewsIQ (AI news sentiment), AssetIQ (opportunity scoring), AnalysisIQ (analyst ideas + an Automated signals variant), and Signal Stream (embeddable trade-idea feeds), plus Economic & Corporate Calendars enriched with Dow Jones Newswires. With the official cTrader integration, these modules are rendered in-platform via plugins/WebView, allowing traders to see what has moved, why it matters, and possible next steps without leaving the cTrader interface.

What traders get to enjoy inside cTrader

- NewsIQ panel (sentiment at a glance): a symbol-aware widget in the instrument panel showing aggregate news sentiment, momentum, and headline density; traders can click to expand recent drivers without leaving cTrader.

- AssetIQ (opportunity ranking): a sortable list that scores symbols (trend, volatility, sentiment, and news volume) to help traders prioritise the day’s focus within the platform workspace.

- Event cards & Calendars (economic + corporate): upcoming releases and corporate events embedded as inline cards on the symbol; each card links to a detail drawer with consensus, previous, and “why it matters.” Calendars tie Dow Jones news and forward-looking data to volatility timelines, which is ideal for pre-event prep and post-event reviews.

- AssetIQ (opportunity ranking): A sortable, in-platform list that ranks instruments using Acuity’s Opportunity Score (price trend, news sentiment, volatility, news volume) to help traders prioritise symbols.

- AnalysisIQ & Automated ideas: Short, risk-defined trade-idea cards (analyst-led and automated/NLP variants) that traders can review beside their charts before opening the order ticket.

- Signal/Insight Streams: Continuous, embeddable feeds of trade ideas/insights presented as broker-branded cards inside cTrader panels

- Mobile parity via WebView plugins (iOS/Android), so the same Acuity modules (sentiment, calendars, ideas) render in cTrader Mobile workspaces.

The business angle

Offering a shorter idea-to-ticket path helps traders discover what moved and why, allowing them to place the order directly from the same panel, eliminating the need for tab switching.

The cards couple conviction - sentiment plus event context - with transparent risk framing, encouraging appropriately sized, rules-aligned trades, which is helpful for prop evaluations.

Detailed explainers attached to events reduce reactive support queries after data print.

Case material shows brokers deploying Acuity’s Signal Stream and related modules to accelerate decision-making and shorten the path to placing a trade, without sacrificing context or compliance language. That combination tends to lift engagement and reduce trader churn by building routine usage habits.

Autochartist - real-time patterns, key levels, and risk sizing

Autochartist scans markets in real time for chart patterns, Fibonacci patterns, and key support & resistance levels, delivering actionable trade ideas based on technical analysis. Inside cTrader, Autochartist technical analysis is natively integrated into the user interface, available across instruments and time intervals, providing trading insights for all types of strategies.

What traders get to enjoy inside cTrader

- Autochartist panel/tab (Desktop & Web): a native panel that lists fresh Chart Patterns, Fibonacci patterns, and Key Levels for the active symbol. Traders can open the dedicated Autochartist tab or view items in the Active Symbol Panel (ASP) for this purpose.

- Chart overlays: clicking a detection opens the chart with the pattern/level drawn on it, so users can inspect breakouts/approaches without leaving cTrader, for seamless analysis-to-action.

- Signal details (in-panel): each opportunity includes the pattern type, direction/scenario and relevant price levels. The list updates in real-time as Autochartist scans the markets.

- Mobile experience (iOS/Android): Autochartist Market Analysis is embedded in cTrader Mobile, allowing traders to browse the same familiar UI and tap through to charts directly on their phone.

Case studies from Autochartist and partner platforms report higher engagement, more efficient trade workflows, and improved retention when potential opportunity detections and risk tools are integrated directly into the platform. For prop firms seeking consistent behaviour against rule-sets, Autochartist provides helpful insights.

Trading Central - analyst-led technicals and teachable moments

Trading Central blends human analyst research with AI/pattern recognition to deliver technical and multi-asset insights, educational overlays, and price targets/levels. On cTrader, Trading Central is natively integrated, allowing traders to open positions directly from insights and consume content as part of their everyday workflow.

What traders get to enjoy inside cTrader

- Embedded Trading Central panel/cards in the platform: analyst-driven technical views, levels and scenarios displayed

- On-chart price targets: cTrader trading platform has a charting feature in the viewing options that you can turn on or off called Targets, and if this is selected, you may see on the chart a potential target price to place your take profit or stop loss.

- Education overlays: short explanations of the pattern or method used, embedded alongside the chart view. This feature is particularly useful for new traders and those seeking to expand their knowledge.

FXStreet - live newswire and economic calendar for pros

What it is: FXStreet is a leading independent forex news publisher with 24/7 coverage and one of the most widely used economic calendars. With cTrader integration, brokers can embed feeds, calendar widgets, push notifications, and event timers directly into their platform and website.

What traders get to enjoy inside cTrader

- Real-time news & Economic Calendar: FXStreet’s calendar is fully integrated in cTrader with seamless embedment; traders can access it from a dedicated Calendar tab or via the Active Symbol Panel (ASP).

- Calendar UX details traders see: events listed chronologically with automated refresh, countdowns to releases, local time setting, and quick filtering by market, designed to sit perfectly inside the cTrader layout.

- News & updates surfaced in the Active Symbol Panel: cTrader added FXStreet’s latest news and trading updates directly into the ASP, keeping users on the symbol while they scan headlines.

Business impact of data & signal integrations

Engagement compounds when ideas, context, and execution live together.

When traders can discover a trading idea, understand the rationale behind it, and place the order in the same workspace, they return more frequently and stay longer. Providers consistently report faster idea-to-execution cycles and habitual behaviours, such as scanning signals at session open, which translates into more active days per user and stronger retention cohorts.

Evaluation quality improves when guidance is structured, and payouts become clearer.

Prop firms don’t reward coin-flip risk. Inside cTrader, Trading Central’s analyst overlays, Autochartist’s chart pattern detections, and Acuity and FXStreet’s sentiment and event context help candidates follow rules-aligned, data-driven execution. Crucially, because insights and trades happen in-platform, firms can pair provider interactions with cTrader Reporting API and plugin event logs to show what the trader saw and when they acted. That traceability reduces edge-case violations, shortens investigations, and lowers the risk of payout delays or disputes, since the decision path is documented and reviewable by coaches and compliance.

Integrations signal credibility and differentiate your brand.

Recognisable signal and research brands - like our top 4, clear source attribution, and consistent UX across devices broadcast professionalism. Perception matters in acquisition and retention. Traders are more likely to trust, engage, and stay when the platform curates high-quality guidance where they trade, rather than pushing them to external tabs.

Support tickets decrease when answers are available in-platform.

If a user can see why gold moved or how a stop level was derived right beside the chart, basic “what happened?” tickets drop. Providing transparent in-context education, such as cards, explainers, and levels, also helps prevent escalation during busy macro weeks.

Why cTrader Is the Right Integration Hub

Cloud-first roadmap that lowers Total Cost of Ownership (TCO).

cTrader’s recent releases prioritise mobile-ready WebView/desktop plugins and developer velocity, with free cloud execution for trading robots (cBots) and one-click start from any cTrader platform (Desktop, Web, or Mobile). Your algos keep running in the cloud, even if the app or device is offline. Paired with native Python support in cTrader 5.4, teams ship faster with less custom glue code and manage a single integration surface across devices, resulting in quicker iteration and lower long-term costs to maintain your integration layer.

Brand trust and credibility are firmly established.

cTrader couples open surfaces and WebView/desktop plugins with a mature ecosystem of third-party integrations, and it’s already in the hands of 8 million+ traders across 300+ brokers and prop firms. cTrader turns signal and data add-ons into an integrated platform experience that caters to the needs of all trading styles, strategies, and skill levels on every device.

Open architecture that meets you where you build.

cTrader exposes the right surface for each job: Open API (public), FIX (trading & liquidity), WebServices (accounts), Manager’s API, and Reporting API for analytics. Easily plug providers and internal systems into the stack without re-platforming.

Fast time-to-value with plugins on desktop, web, and mobile.

Beyond native APIs, desktop plugins and WebView plugins enable you to integrate third-party tools, dashboards, or AI helpers directly into the app, complete with user-granted trading permissions. The result is shorter delivery cycles and genuine mobile-first engagement.

An ecosystem that already speaks your language.

The cTrader Store and partner catalogue include over 1000 ready-made solutions, allowing product teams to assemble a best-of-breed stack and ship quickly, much like extending a SaaS product through a marketplace.

Proven paths for the “big four.”

Spotware maintains dedicated integration pages and implementation guidance for Acuity, Autochartist, Trading Central, and FXStreet. That makes evaluation, legal review, and deployment predictable and repeatable across brands.

Copy/social & evaluation adjacencies are built in.

If your playbook includes social discovery or strategy marketplaces, cTrader Copy is native. Ideal for converting “signal readers” into strategy followers, it offers clear disclosures and controls.

Key takeaways for founders & executives

- A brand you can stand behind. Recognisable providers presented in a consistent cTrader UX signal professionalism and credibility, lifting conversion in sales cycles and instilling more confidence among traders.

- Compliance and governance are simplified. cTrader is optimised for flexibility and puts control in your hands. Turn modules on/off by account type and region, standardise disclosures, and keep an audit trail. Scale features without creating regulatory drag.

- An Ecosystem you don’t have to build. The “Big Four” cover the spectrum. Acuity (sentiment & calendars), Autochartist (patterns & entry/exit frameworks), Trading Central (analyst research & teachable technicals), FXStreet (real-time news & events). Deployed together, they explain markets and help guide common-sense behaviour, supporting trader longevity.

- cTrader is designed for integration. As an Open Trading Platform™, it provides the ideal surface for every job. With Open/FIX/WebServices/Manager’s Reporting APIs, desktop and WebView plugins, and a growing store ecosystem, you can roll out best-in-class tools faster, while providing your traders with the same reliable user experience on mobile, where engagement is increasingly concentrated.

- Treat signals & data as retention infrastructure. Your edge lies in delivering decisions with context within the trading flow. Make “idea to context to execution” a single path on every device.

Conclusion

cTrader’s combination of pro-grade market structure, open APIs, and modern UX is hard to beat. Firms that invest in high-quality, in-platform integrations build credibility, increase trader activity, and scale more sustainably because the product itself teaches, informs, and reduces friction. Put simply: the right integrations turn a platform into a complete trading ecosystem - and cTrader gives you that edge.

Get in touch with our sales team to learn more.

FAQ

Does cTrader support all major third-party integrations?

Yes. As an Open Trading Platform™, cTrader maintains a large ecosystem of integrations (including Acuity, Autochartist, Trading Central, and FXStreet), and Spotware’s team handles custom work if something isn’t listed. Plugins (native & WebView) and Open API make embedding third-party tools straightforward across desktop, web, and mobile.

Which market-data integrations do brokers and prop firms use most on cTrader?

The most common stack consists of Acuity (AI news & sentiment), Autochartist (patterns & key levels), Trading Central (analyst research and technicals), and FXStreet (real-time news & economic calendar). Each of these popular providers has an official cTrader integration page.

Can these integrations work on web and mobile cTrader apps?

Yes. Trading Central, Autochartist, and FXStreet ship as native, in-the-box cTrader integrations, and Acuity can be added on request. Once enabled by the broker, these integrations are available across Desktop, Web, and Mobile with a consistent user experience.

Can prop firms use integrations in evaluation accounts?

Yes. cTrader is widely used by prop firms. Integrations are enabled by the broker and can be displayed or hidden based on account type or group (e.g., demo, evaluation, funded, live). Many prop firms configure them for evaluation phases alongside their challenge/lifecycle tooling. (Licensing remains vendor-specific.)

How do signals improve trader retention?

Signals/research increase platform stickiness by providing explainable ideas and context where trading decisions are made. Industry review methodologies explicitly weight research & education, and provider case studies emphasise engagement when insights are embedded in-platform. Treat signals as additive to pricing and execution, not a substitute.

Is Acuity better for news sentiment or trading signals?

Acuity’s strength lies in AI-powered news sentiment and event intelligence, as well as trade ideas. For pure pattern-based signals, pair it with Autochartist or Trading Central - most brokers deploy Acuity and at least one technical provider for full coverage.

What’s the difference between Acuity, Autochartist, Trading Central, and FXStreet?

They are all providers of world-class trading research, signals, and expert trading tools. Highlighted benefits inside cTrader are as follows:

- Acuity: AI-driven news sentiment, economic calendars, and curated trader insights.

- Autochartist: Real-time, automatically detected chart patterns/Fibonacci levels, and key levels with trading insights.

- Trading Central: Analyst research and patented technical pattern tech.

- FXStreet: Independent real-time news & economic calendar.

How fast is rollout on cTrader?

Fast. You can enable ready integrations from Spotware’s ecosystem or ship UI quickly with WebView plugins. Spotware also offers an integration team for partners not yet listed.

Do these tools place trades automatically?

By default, they deliver analysis. cTrader WebView/desktop plugins can place or modify orders only with explicit user permission, preserving control and auditability.

Can we combine multiple signal providers?

Yes, many firms run Acuity and Autochartist, or Trading Central and FXStreet, so traders get comprehensive insights to guide their trading strategies. Idea - context - execution in one flow.