In 2026, brokerage infrastructure is no longer defined solely by access to markets. The real differentiation lies in how effectively a firm manages capital, liquidity, technology and counterparty risk. Selecting between a prime broker and an executing broker determines not only how trades reach the market but also how the entire brokerage operates, scales, and allocates its resources.

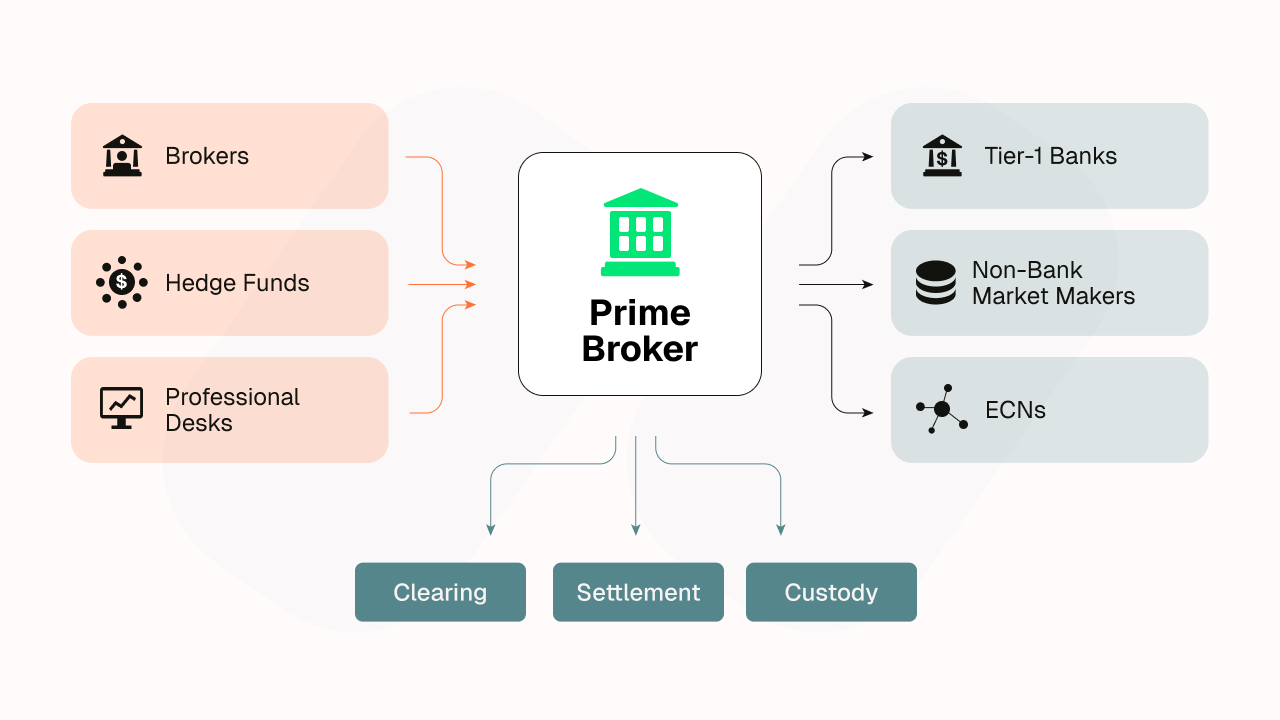

Prime brokers act as strategic partners, providing institutional-grade services such as credit intermediation, consolidated liquidity access, clearing, settlement and custody. Their role is built around supporting large, balance-sheet-intensive operations that require leverage, multi-asset capabilities and sophisticated post-trade infrastructure.

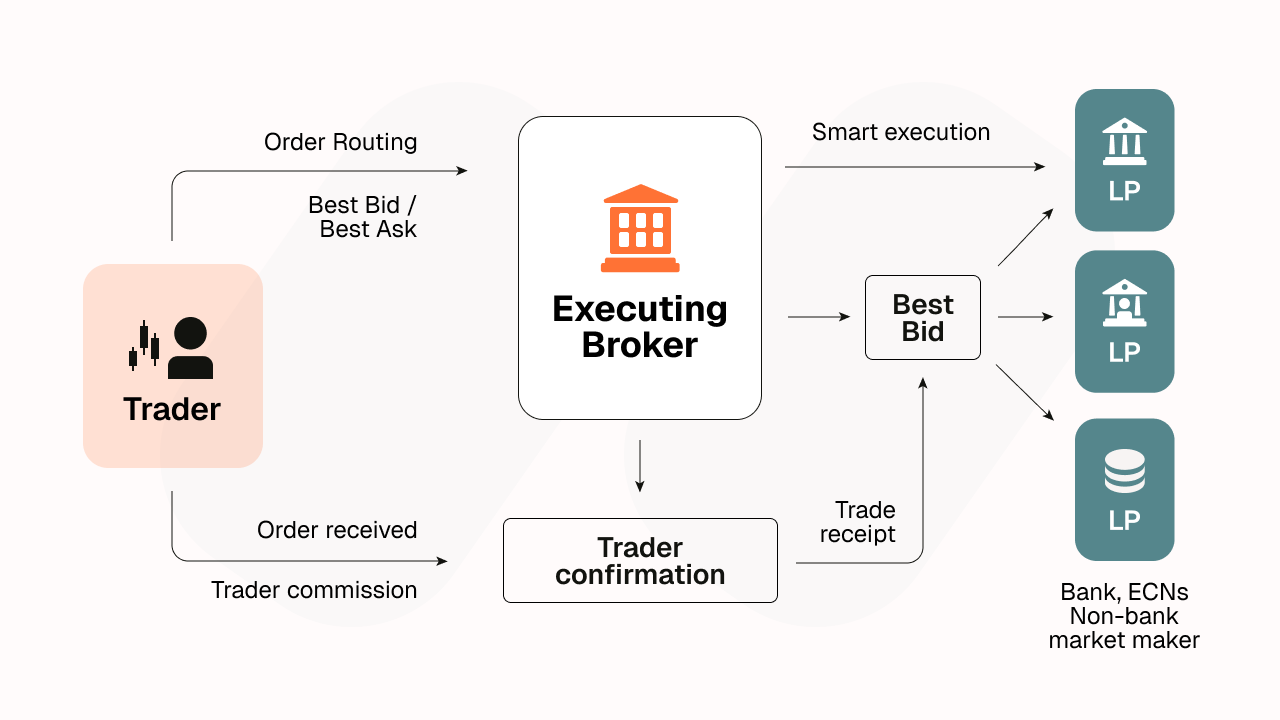

Executing brokers, by contrast, operate at the execution layer of the market infrastructure. Their focus is speed, pricing, routing efficiency and transparency. They do not provide financing or custody; instead, their competitive edge depends on execution quality, smart routing, latency optimisation and stable connectivity to liquidity venues.

This article breaks down how each model functions, who it is designed for, and how the choice between them affects capital efficiency, operational control, risk management and long-term scalability. We also explore hybrid structures, including Prime-of-Prime (PoP) models, which bridge institutional liquidity with lower entry requirements for smaller brokers.

What is a prime broker?

Instead of managing separate credit and operational relationships with multiple liquidity providers, a brokerage works through a prime broker that extends aggregated access to Tier-1 banks, non-bank market makers and ECNs under a unified credit line. The prime broker then handles post-trade processing, settlement and custody through its clearing relationships, while optimising capital usage and credit exposure. This setup simplifies operations and improves overall capital efficiency for institutional brokers.

Core services and institutional value of prime brokers

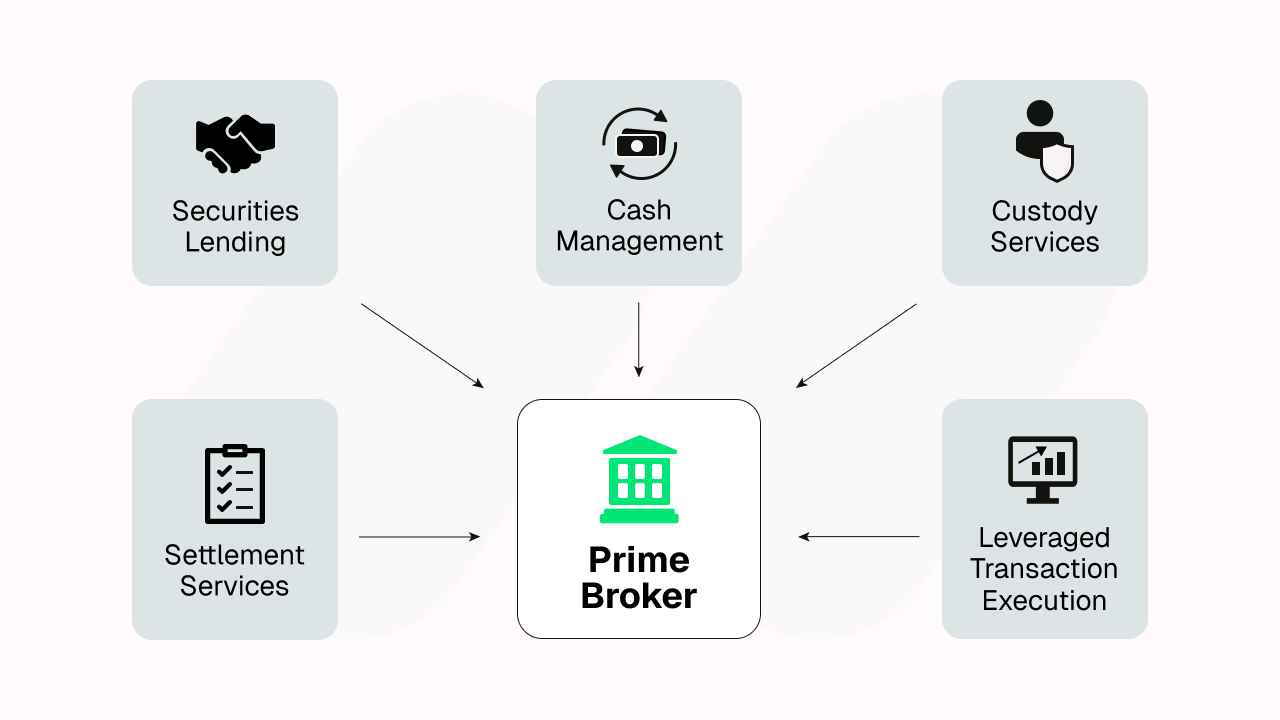

At its core, a prime broker functions as the operational nerve centre of a trading business. They consolidate risk, financing and execution into one streamlined framework.

- A major component is trade clearing and post-trade services. Prime brokers facilitate access across multiple asset classes, FX, equities, fixed income and derivatives, while managing the clearing, settlement, and custody processes that keep trade flows efficient and consolidated. This centralised model not only simplifies reporting but also reduces counterparty exposure.

- Another defining feature is margin and financing. By holding client assets in custody, prime brokers can extend credit and leverage, enabling firms to access greater market exposure within controlled risk parameters. This capital efficiency is a major reason institutional desks and hedge funds rely on prime brokerage relationships.

- Securities lending (prime financing) enables short selling by arranging stock borrow and managing the full lifecycle—locates, collateral, recalls, and settlement—across counterparties. For hedge funds and market makers, consistent borrow availability and competitive rates are critical to executing long/short and arbitrage strategies efficiently.

- Alongside financing and execution, prime brokers offer custody and integrated risk management, combining asset protection with regulatory compliance and consolidated performance analytics. Clients receive real-time monitoring tools, margin alerts and comprehensive portfolio-level reporting.

- Finally, there’s capital introduction and operational support, the softer but highly valuable side of the business. Prime brokers connect fund managers and institutional desks to potential investors, provide access to internal research and offer operational consulting that helps clients scale efficiently. For many hedge funds and proprietary firms, this ecosystem of connections and insights is as valuable as the credit itself.

Who uses prime brokerage?

Typical eligibility is set by prime brokers themselves, based on the level of credit risk they are willing to take. Entry requirements usually consider a firm’s assets under management (AUM), trading frequency, strategy complexity and overall risk profile. In practice, this means that clients may need anywhere from mid-six-figure capital deposits to tens of millions in equity, depending on the prime broker, asset classes traded and the size of the credit line being requested.

The types of firms that typically qualify for prime brokerage services: hedge funds, proprietary trading firms, large brokerages, family offices, market-making desks and institutional crypto participants share several common traits: large transaction volumes, cross-asset exposure and the need for credit intermediation to manage margin across multiple counterparties. Prime brokers allow these firms to operate globally, hedge efficiently and deploy strategies that would otherwise require massive capital buffers.

Risks and considerations

Prime brokerage relationships offer strategic advantages but also introduce exposure that must be carefully managed. Relying heavily on a single counterparty can create balance sheet and concentration risk, while excessive leverage can magnify drawdowns during volatile market periods.

Since the 2008 financial crisis, successive regulatory reforms, including Basel III (and its subsequent revisions often referred to as Basel IV), MiFID II and the DORA framework, have continued to reshape how brokers manage capital, credit and technology. These frameworks have tightened capital adequacy rules, raised reporting standards and expanded operational resilience requirements, pushing brokers to maintain higher transparency and more robust risk management systems.

To mitigate these challenges, many institutional firms now operate multi-prime models, distributing exposure across several prime brokers. This diversification helps maintain continuity of trading operations and preserves access to credit and liquidity even when one provider changes its terms.

In this environment, technology plays a critical role. Platforms like cTrader enable brokers to meet transparency and operational standards by providing detailed execution data, real-time reporting and secure infrastructure.

Function | Spotware Solution | Value |

Liquidity aggregation & clearing control | cTrader Server (with upcoming cBridge integration) | Aggregates liquidity from multiple LPs and powers smart order routing. |

Credit and margin control | cTrader Admin | Allows group-level limits, margin tiers, max drawdown and account risk settings. |

Reporting & audit trails | Reporting API + trade receipts | Provides institutional-grade transparency for regulatory oversight. |

White-label & sub-broker management | cTrader Admin | Supports managing multiple entities (white labels or partner brokers) under one umbrella. |

For modern prime brokers, the true differentiator lies in execution speed, transparency and seamless liquidity management technology. Smart order routing and aggregation across multiple LPs ensure minimal slippage and optimal pricing for institutional clients, while transparent reporting strengthens credibility and regulatory compliance. Equally critical is system interoperability - the ability to connect liquidity sources, trading platforms and risk control tools into one efficient, fully visible ecosystem. Together, these factors form the technological foundation of a high-performance prime brokerage, supporting scale, stability and client trust.

Spotware’s cBridge sets a new standard in broker connectivity, combining innovation, reliability and scalability in a single gateway to liquidity.

Designed for Prime and Prime-of-Prime brokers, cBridge enables secure, high-performance connection, aggregation and management of liquidity across multiple venues.

Contact Sales today and be among the first to experience the future of institutional liquidity connectivity.

What is an executing broker?

Essentially, executing brokers are specialists in price discovery and trade completion. Depending on their scale, they may aggregate liquidity either directly (from ECNs, exchanges and dark pools) or via bridge solutions that aggregate quotes across venues for best execution and minimal slippage.

Most retail brokers work with one or multiple executing brokers behind the scenes to route orders from platforms like cTrader to real liquidity pools.

Execution brokers make their money through spreads, commissions, or sometimes both. And depending on how your setup is, whether you’re A-Book, B-Book or Hybrid, this relationship can be really important.

Core services and institutional value of executing brokers

At their foundation, executing brokers manage order routing, liquidity aggregation and access to price discovery. Using smart order-routing algorithms, multiple market data sources and direct market access,

They draw liquidity from multiple counterparties, Tier-1 banks, non-bank liquidity providers and ECNs, building a unified liquidity stack that supports multi-asset execution. This structure allows brokers to offer tighter spreads, better depth of market and faster order execution to clients.

Execution transparency is central to their role. Executing brokers provide detailed post-trade reports showing execution venues, fill quality and latency metrics. For brokerage executives, this level of visibility is essential for both regulatory compliance and internal performance benchmarking.

From a technology standpoint, executing brokers become tightly integrated into a broker’s infrastructure. They connect through APIs or bridge systems to deliver real-time pricing, execution feedback and order-level data directly into trading platforms. In high-performance trading environments, these integrations typically operate within low-latency, co-located hosting facilities such as Equinix LD4 or NY4 - a standard increasingly expected in institutional-grade setups.

Solutions like cTrader for FX/CFD brokers reflect this level of technological precision, combining direct liquidity connectivity, transparent execution flows and seamless API integrations within a secure, scalable deployment architecture.

The difference between prime and executing brokers

While prime brokers manage capital and credit, executing brokers manage execution quality and technology. Both serve the same ultimate goal, delivering reliable market access and client confidence. In 2026, the most successful firms will combine these ideas using hybrid or Prime-of-Prime structures. They will blend the financial strength of prime brokerage with the agile technology of execution-driven models.

Prime brokers operate at the institutional level, providing credit, clearing, settlement and custody to large financial entities. Their earnings come from financing spreads, clearing fees and balance sheet efficiency, rather than direct trade execution. To stay competitive, prime brokers must maintain strong capital reserves, Tier-1 liquidity access and regulatory resilience, ensuring client trust through financial stability and transparency.

Executing brokers specialise in trade routing and execution, connecting traders to global liquidity sources. Their revenue depends on spreads, commissions and execution performance.

To lead the market, executing brokers invest heavily in low-latency infrastructure, smart order routing and transparent reporting. Trading platforms, in turn, must integrate seamlessly with this execution layer. This is where cTrader for FX/CFD brokers becomes essential: its architecture is specifically designed to connect efficiently with executing brokers through bridge technology, FIX API and liquidity-level integrations. Instead of enabling the execution itself, cTrader plugs into the broker’s liquidity stack, supporting multi-LP aggregation, real-time analytics and transparent execution data that allow brokers to translate execution quality into a visible competitive advantage for their clients.

Why execution quality matters?

Technology drives everything in executing brokerage. How fast can orders get routed? How sophisticated are the smart order routing algorithms? How stable are the connections to liquidity venues? These factors impact fill rates and slippage. A slow order router means you're trading on stale quotes. Poor venue selection means you're not getting the best available price.

Moreover, transparency builds trust. Clients want to see where their orders executed, what transaction costs and how their fills compared to quoted prices. Good executing brokers provide detailed transaction and execution reporting that answers these questions.

Additionally, integration matters. Your executing broker must plug cleanly into your trading platform through standard APIs, including FIX connectors, and align with your existing technology stack. The smoother this integration is, the faster you can go live and maintain stable execution at scale.

Function | Spotware Solution | Value |

Order routing & execution | cTrader platform + cBridge + FIX API | Connects to liquidity pools, executes orders at sub-millisecond speed and ensures fair market execution. |

Transparency | Detailed trade receipts & Level 2 data | Brokers can prove fair execution to clients and regulators. |

Trader experience | Multi-device cTrader UI | Builds trust and retention among retail clients. |

Compliance-ready hosting | Proxy Cloud & Equinix data centres | Reduces operational and regulatory risk. |

Prime broker vs. executing broker

Feature | Prime Broker | Executing Broker |

Core Purpose | Provide bundled services, including clearing, custody, financing and risk management | Focus on fast and reliable trade execution and order routing |

Clients Served | Institutional clients like hedge funds, proprietary trading firms and large brokerages with substantial capital requirements. | Retail traders, fintech startups and smaller institutions with lower capital thresholds. |

Services Offered | Clearing, settlement, asset custody, margin financing and credit intermediation | Order execution, trade routing and basic clearing |

Risk Exposure | Higher due to credit lines and financing provided to clients | Lower, mostly execution risk |

Technology Needs | Advanced platforms supporting complex risk management, reporting and multi-asset liquidity | Systems optimised for speed, stability and direct market access |

Fee Structure | Typically includes financing fees, commissions and service charges. Some prime brokers also offer profit-sharing structures for high-volume institutional clients. | Mostly spreads and/or commissions on trades |

Regulation & Counterparty Risk | Subject to strict regulatory standards, it carries counterparty credit risk via financing | Regulated for execution services; lower credit risk exposure |

Prime-of-Prime Brokers

It is important to mention that with the evolution of trading technologies and the industry’s growing market experience, new business models have emerged to meet the changing demands of brokers and liquidity providers. One of the most significant of these is the Prime-of-Prime model - a structure that bridges the gap between Tier-1 prime brokers and smaller institutions that cannot meet the high entry thresholds of direct prime access.

The Prime-of-Prime concept gained traction after the 2008 financial crisis, when large banks and Tier-1 primes tightened credit policies and raised collateral requirements. Smaller brokers and prop firms were left seeking a way to access institutional liquidity without the need for multimillion-dollar capital commitments. PoP brokers filled that void.

These providers maintain relationships with Tier-1 prime brokers and major liquidity sources, acting as a credit and liquidity conduit for mid-tier brokerages, prop firms and trading desks. In practice, a PoP consolidates several smaller brokers under its umbrella and presents them to a Tier-1 prime as a single, creditworthy counterparty. This structure allows participants to trade with institutional-grade liquidity, leverage and clearing services, without assuming the full regulatory and capital burden of a direct prime relationship.

Although the model introduces an additional counterparty layer and slightly higher transaction costs, it offers clear advantages: deeper liquidity, enhanced execution quality and faster scalability for growing brokers. For firms that operate in dynamic, high-volume environments, PoP arrangements provide a practical path toward institutional-level performance.

Spotware is extending this evolution with cBridge, a next-generation liquidity gateway designed specifically for Prime-of-Prime and executing brokers. It simplifies how brokers connect, aggregate and manage institutional liquidity through secure, high-performance infrastructure.

Contact Sales today to be among the first to experience the future of liquidity connectivity.

Impact on brokerage operations

The choice between a prime broker and an executing broker directly shapes a brokerage’s operating structure, capital strategy and scalability. For company owners, this choice determines not just how trades are executed, but how efficiently they can grow the business while managing risk and liquidity exposure.

Prime broker

Best suited for large or institutional brokers that handle high volumes and require balance sheet efficiency, credit intermediation and consolidated liquidity. This model simplifies post-trade processes: clearing, settlement and reporting under a single counterparty. However, it demands significant upfront capital and robust compliance frameworks to maintain regulatory standards and credit lines.

Executing broker

A common choice for retail-focused or startup brokers entering the FX/CFD market. It provides direct market access with lower capital requirements, enabling faster launch timelines and operational flexibility. Instead of managing credit or financing, the broker focuses on execution speed, pricing transparency and client experience - areas that strongly influence growth and reputation.

Operational factors to consider

Choosing between a prime broker and an executing broker affects every aspect of your day-to-day operations - from settlement and margin management to reporting, execution speed and scalability. Understanding these operational differences helps brokers plan infrastructure, control costs and ensure long-term growth efficiency.

Settlement and margin arrangement: Prime brokers manage clearing, settlement and margin processes within a single counterparty relationship, ensuring one cohesive workflow. Executing brokers, on the other hand, usually work with separate clearing firms, which adds complexity but provides greater flexibility.

Reporting capabilities: Prime brokers provide sophisticated portfolio analytics and real-time risk dashboards, while executing brokers focus on transaction-level reporting and you'll need to build or buy portfolio-level risk management tools.

Execution speed & stability: Executing brokers prioritise ultra-low latency and stable routing; prime brokers excel at liquidity aggregation and operational efficiency across venues.

Scalability and cost implications

Prime broker model

Scaling under a prime brokerage arrangement is capital-intensive but operationally efficient once established. Because the prime broker handles clearing, settlement and margin financing, operational costs per trade typically decrease with higher volumes, creating strong economies of scale. However, entry requirements are steep: firms must maintain significant regulatory capital, meet credit standards and comply with complex reporting obligations. For large or institutional brokers, the payoff is long-term balance sheet efficiency and better liquidity pricing through consolidated flows.

Executing broker model

Executing brokers scale primarily through technology and automation, not capital. Their growth depends on expanding client volume, optimising routing speed and integrating with multiple liquidity providers. Initial setup costs are lower; no credit lines or clearing relationships are required, but technology infrastructure, platform licensing and liquidity fees become ongoing variable costs. As the client base grows, automation of onboarding, reporting and risk control becomes key to maintaining margins.

In practice, executing brokers scale faster because of lower barriers to entry and shorter setup times, while prime brokers scale deeper, achieving better cost efficiency at high volume once capital and compliance frameworks are in place.

To streamline operations at any stage, cTrader by Spotware provides the complete technology stack, from execution routing and FIX connectivity to reporting APIs and risk management tools, enabling brokers to grow efficiently without building internal infrastructure. Learn more about cTrader solutions for brokers.

Technology and infrastructure considerations

Execution transparency is now a regulatory and reputational standard. Brokers must prove how and where trades are executed, manage latency to prevent slippage and maintain detailed reporting for audits and compliance.

Integration architecture

Prime brokers operate with more complex integration requirements because their systems must perform clearing, settlement and real-time risk calculations. Their infrastructure needs a continuous two-way data exchange with the brokerage, including order flow, position updates and margin information, so that the prime broker can monitor exposure and enforce risk limits when necessary.

Executing brokers, in contrast, require a more streamlined setup. The brokerage connects to the executing broker’s routing engine through a bridge or API, transmitting orders and receiving fills. Since executing brokers do not provide financing, cross-margining or portfolio-level risk oversight, they do not require visibility into the brokerage’s full positions or margin data.

Execution transparency

Prime brokers provide detailed trade receipts that show execution venue, counterparty and all-in costs (like custody and clearing fees). This transparency helps with transaction cost analysis and reporting.

Executing broker offers simpler receipts with basic information (venue, timestamp, price, commission). No financing or custody fees are included, making the data less comprehensive but easier to understand.

Latency management

Prime brokers face latency mainly from pre-trade risk checks, typically adding 5-20ms before order routing. Executing brokers conduct lighter checks and can clear orders in 1-3ms, resulting in total routing latency often under 10ms. This makes them ideal for high-frequency trading.

Regulatory reporting

Prime brokers manage most regulatory reporting as part of their services, handling filings under regulations like MiFID II. Executing brokers only report on their transactions. You are responsible for aggregating data from multiple brokers for consolidated reporting.

Overall, prime broker setups require more complex integration and reporting features, while executing broker setups focus on speed and simpler data management.

Which model should you choose?

As we discussed earlier, selecting between a prime and executing broker model depends on your company’s size, capital resources and growth ambitions. Each approach offers distinct advantages and the right choice should align with your risk appetite, client profile and operational maturity.

Prime broker model

Best for established or institutional brokers with substantial capital and regulatory standing. It offers direct access to Tier-1 liquidity, cross-margining and centralised clearing, but requires significant investment and ongoing compliance oversight.

Executing broker model

Ideal for new or retail-focused brokers seeking faster market entry and lower initial costs. This setup prioritises execution quality, price transparency and flexible integration with liquidity providers, enabling firms to scale through technology rather than credit.

Hybrid paths

Most successful brokerages start with executing broker relationships. This lets you validate your business model without overinvesting in infrastructure you don't need yet.

Adding a PoP provider comes next for many operations. You get better liquidity and institutional-grade leverage while building the capital and client base needed for direct prime relationships.

Eventually, large brokerages establish direct prime relationships for institutional business while maintaining executing broker connections for retail flow. This hybrid approach optimises costs, diversifies liquidity access and positions brokers to scale efficiently across different client tiers

Conclusion

Prime brokers and executing brokers serve different purposes. Prime brokers provide comprehensive services that make sense for institutional-scale operations with substantial capital. Executing brokers deliver efficient, cost-effective execution for brokerages focused on retail or mid-market clients.

The right choice depends on your operational scale, target clients and available capital. Most brokerages start with executing broker relationships and evolve toward prime or hybrid models as they grow.

Technology choices matter as much as broker relationships. Platforms like cTrader provide the flexibility to adapt as your business scales, whether you're routing to a single executing broker or managing complex prime relationships. Talk to our Sales Team to learn how cTrader supports both models.