Cost-efficient liquidity bridge

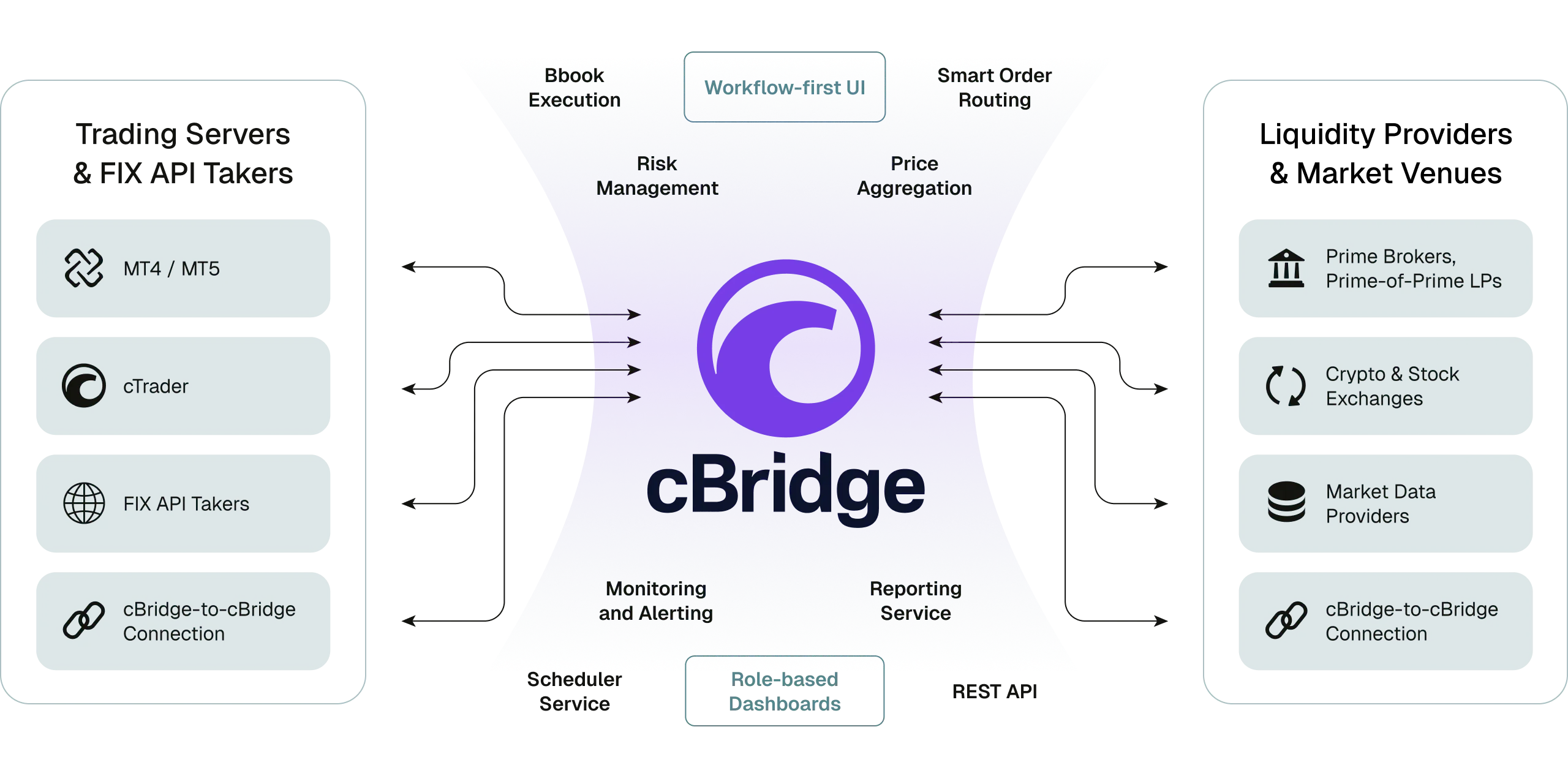

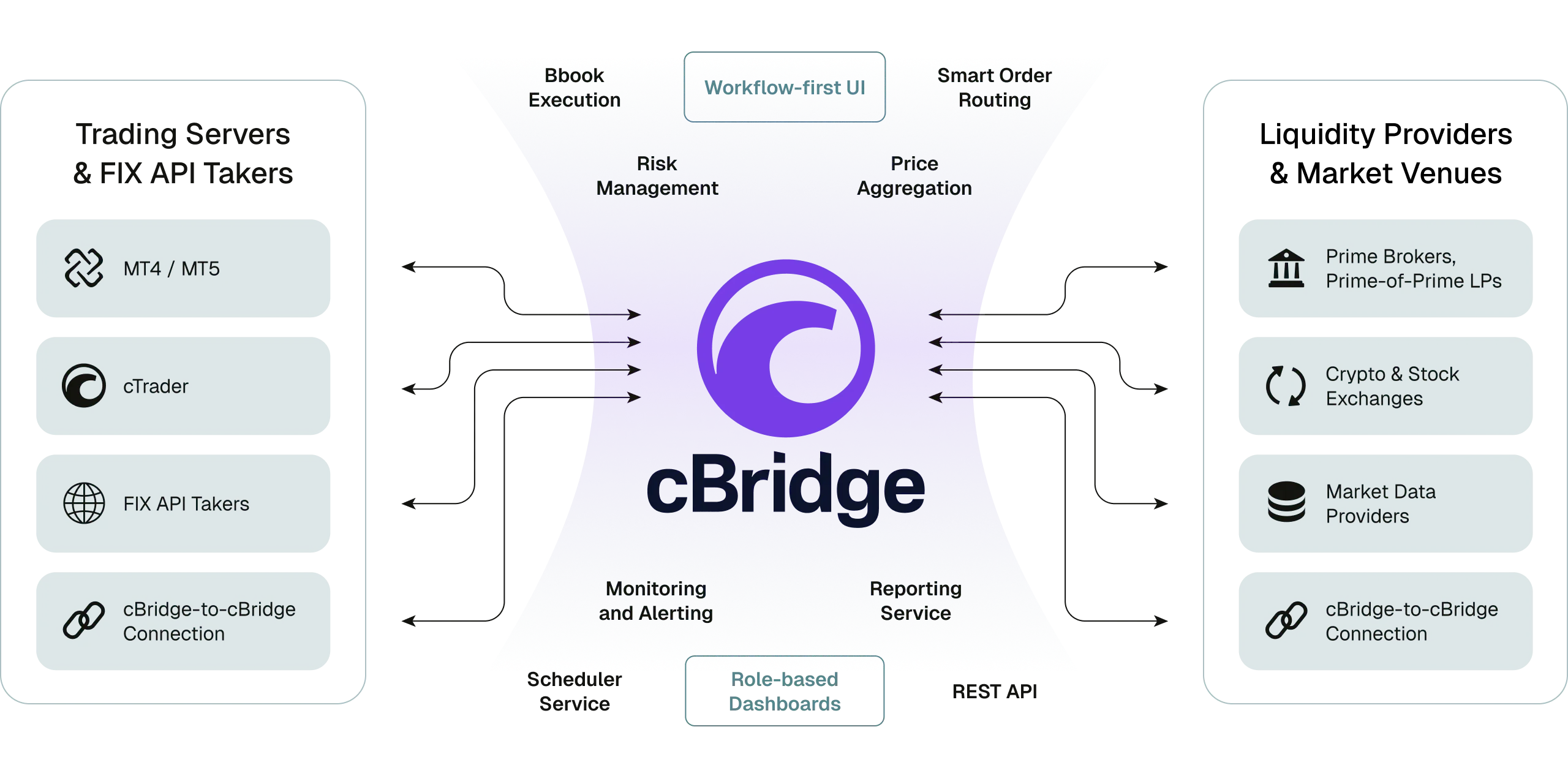

cBridge brings together innovation, reliability, and usability to deliver a seamless gateway to liquidity.

No volume fee and hidden charges

cBridge offers transparent, infrastructure-based fees that scale predictably with each trading server connection, making it easy to forecast budgets for prop firms and CFD brokerages.

Cut bridge costs by up to 80%

Our fixed pricing replaces traditional per-volume billing used by most bridge providers, unlocking stronger marketing, or more competitive partner payouts.

No volume fee and hidden charges

cBridge offers transparent, infrastructure-based fees that scale predictably with each trading server connection, making it easy to forecast budgets for prop firms and CFD brokerages.

Cut bridge costs by up to 80%

Our fixed pricing replaces traditional per-volume billing used by most bridge providers, unlocking stronger marketing, or more competitive partner payouts.

Workflow-first design

Purpose-built layouts with context panels and cross-settings references speed up setup and troubleshooting.

Multi-platform integration

Seamless integration with various trading platform types and protocols: cTrader, MT4, MT5, FIX API.

Intuitive order routing

Color-coded validation makes routing logic easily scannable, enhancing dealers’ rule overview and speeding up configuration

Flexible modular architecture

Enables individual scaling and maintenance of resource-intensive modules without impacting other parts of the system.

Zero downtime

Built on a distributed architecture for high availability. Upgrades and scaling can be done seamlessly with no interruption.

Role-based dashboards

Out-of-the-box views and alerts for dealing, risk managers, operations, CEO, each with tailored KPIs and drill-downs.

Protection and risk management

Monitoring and reporting

cBridge delivers an intuitive interface built for real-time visibility and control across all connections. Role-based dashboards ensure that dealers, risk and compliance teams can monitor the key KPIs, exposure, and execution performance with total clarity.

Talk to sales