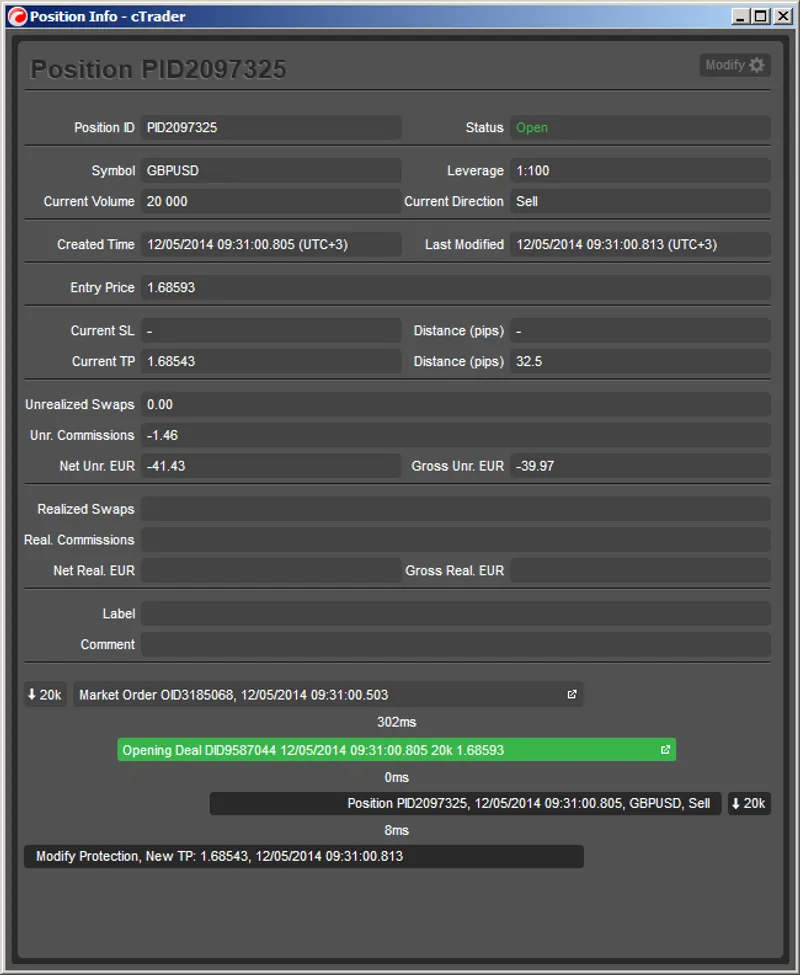

cTrader, the STP trading platform from Spotware Systems, has received a major overhaul of the way trades are displayed in the application. The overall level of transparency has been greatly enhanced with a full breakdown of positions into orders (trade requests from traders to the LP) and deals (LP execution reports).The new structure will also be available on cAlgo, Spotware's algorithmic trading platform, and cTrader Web (cTrader's twin HTML5 platform). Alex Katsaros, who heads the cTrader development team, explained: "This kind of position breakdown is a great way for users to see exactly what's happening with each trade, from opening click to closed position." New 'information windows' provide traders an exhaustive set of all details relating to individual positions, orders, and deals. These details include exact matching times, fill times, and fill rates, while 'timelines' at the bottom of the window show all related trading events in order of when they occurred. Market Snapshots are also shown for every deal. These snapshots give users a precise view of market pricing and liquidity at the exact time of execution, helping them to understand why a deal was filled at the price it was, or why it may have been partially filled. Katsaros heralded the latest release as yet another step towards building trust between all counterparties. "This kind of itemization and depth of information for each trade isn't available on any other FX platform. We've added another milestone in our commitment to extreme transparency, which we believe benefits not only traders but brokers as well. Of course, the principle is far from exclusive to financial trading - businesses all over the world are raising their efforts to be more transparent because they've seen how well it benefits all parties. "We can't wait for traders to finally get this quite fascinating view of their own trading, and we look forward, as ever, to lots of feedback."

News

Articles

14 min read

Top 4 Trading Signal & Market Data Integrations Every Broker and Prop Firm Needs

Investors and traders today are spoilt for choice. Yes, they want attractive spreads and leverage, but today’s competition is also defined by credibility and user experience. Traders expect high-quali...

Articles

18 min read

CRM Systems for Prop Trading: The Ultimate Guide to Scaling Your Proprietary Trading Firm in 2025

The proprietary trading industry has exploded in recent years, with search demand for "prop firm" skyrocketing by 8,409% between early 2020 through mid-2024. As the sector evolves and matures, success...

Articles

14 min read

Do prop firms use real money? Understanding risk models and sustainable growth

Launching a proprietary trading firm is exciting, but the first decision is how much capital to risk. In practice, firms do not hand new participants large live accounts straight away. Candidates begi...