Today's brokerage entrepreneurs face a critical infrastructure decision that will shape their business for years to come. Should you operate as a white label partner under another broker's umbrella, or establish a main label operation with direct platform licensing?

This choice extends beyond setup costs and technical considerations. It determines your market positioning, profit potential, operational flexibility, and growth ceiling. White label solutions offer an attractive entry point with minimal investment. However, experienced operators increasingly recognise that main label operations provide the only sustainable foundation for long-term success.

The distinction is strategic. White label operators function within boundaries set by their providers. Main label brokerages chart their own course with complete autonomy. In today's competitive landscape, this independence is essential for serious market players.

Understanding the business models

A white label brokerage operates under an existing broker's infrastructure, regulatory licenses, and liquidity arrangements while presenting its own brand to clients. Think of it as a franchise model. You gain immediate access to proven technology and compliance frameworks, but within strict parameters.

Main label operations represent authentic independence through direct platform licensing. Your company secures its own regulatory licenses, maintains direct relationships with platform providers like cTrader, and retains full control over client experience, pricing and operations.

White label: The franchise approach

White label arrangements include access to established trading platforms, basic branding customisation, shared liquidity pools, and simplified compliance through the provider's licenses. This offers an attractive shortcut to market entry with minimal complexity.

However, beneath this convenience lies a fundamental limitation: permanent dependency. White label operators function as sophisticated resellers rather than independent brokerages. They're constrained by their provider's decisions, profit-sharing requirements, and strategic priorities. Every significant business decision must align with the provider's interests, not necessarily your own.

The appeal is immediate market entry. The cost is surrendering long-term control and accepting permanent profit caps that compound over time.

Main label: True independence

Main label brokerages own their strategic destiny. They select technology partners directly and design operational frameworks according to their vision. They establish direct relationships with liquidity providers and capture 100% of revenues without permanent revenue-sharing obligations.

With platforms like cTrader offering direct licensing, main label operations have become more accessible while maintaining complete independence. This enables brokers to build genuine market differentiation impossible under white label constraints.

White label operators essentially rent their business model. Main label operators build, own and control their own completely.

The main label advantage

Complete brand control

Main label operations eliminate the most dangerous risk facing white label operators: shared reputation exposure. When you operate under white label, your brand becomes permanently intertwined with your provider's performance and the conduct of every other partner operating under the same infrastructure.

A compliance issue, technical failure, or reputation crisis affecting your provider - or any of their partners - can instantly damage your brand equity and client relationships.

Main label brokerages insulate themselves from these external risks while maintaining complete control over market positioning. They customise every client touchpoint - from platform interfaces and trading conditions to marketing materials and customer service protocols.

With cTrader's extensive customisation capabilities - including fully branded mobile apps - main label brokerages create truly distinctive client experiences. The platform's comprehensive branding options ensure your market identity permeates every aspect of the trading environment.

Ideal for: Established entrepreneurs with clear brand vision, brokerages in competitive markets requiring differentiation, and companies prioritising long-term brand equity.

Strategic considerations: Requires a comprehensive brand strategy and consistent execution, but provides unlimited differentiation potential.

Complete profit retention

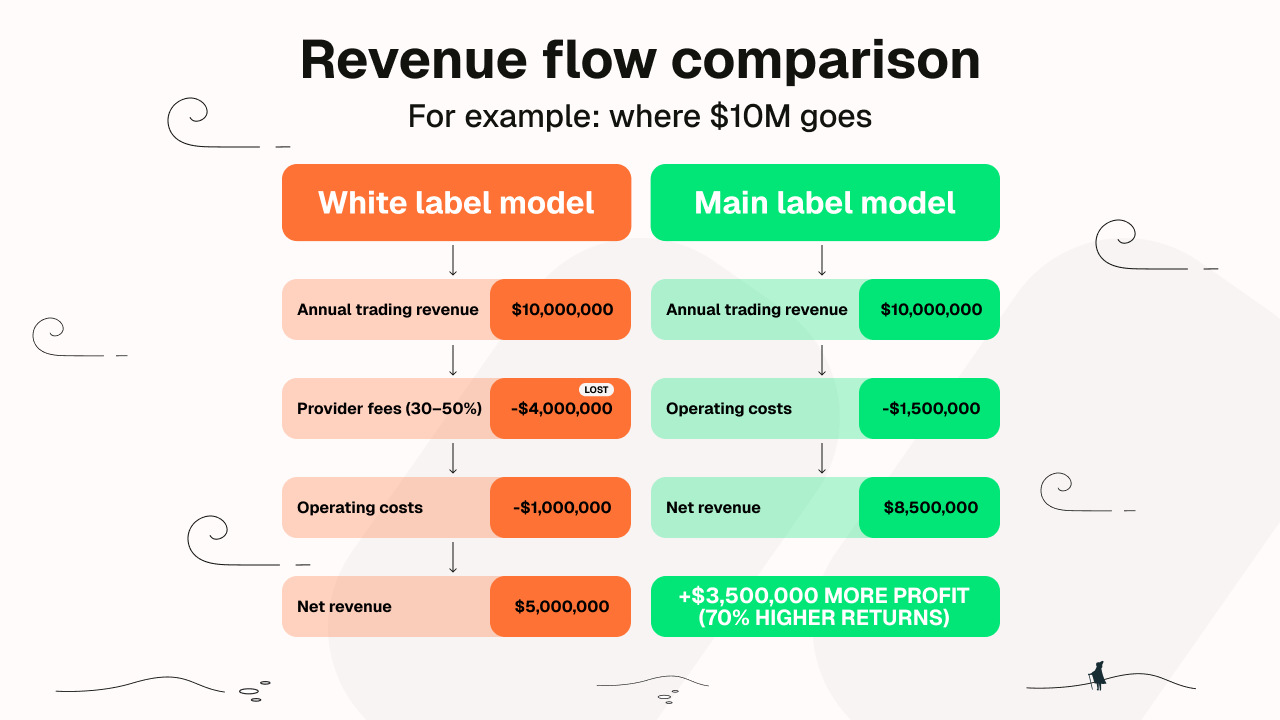

The mathematics reveal the most compelling advantage: complete profit retention without permanent revenue-sharing obligations. White label arrangements typically involve substantial revenue sharing (20-50% of income). This caps your profit margins permanently, regardless of performance or growth.

Main label brokerages, on the other hand, keep every dollar generated from client trading activity, spreads, commissions, and ancillary services. Beyond traditional income, cTrader offers additional revenue streams through cTrader Store - a marketplace connecting brokers to millions of traders and offering trading robots, indicators and plugins with built-in licensing and secure transactions.

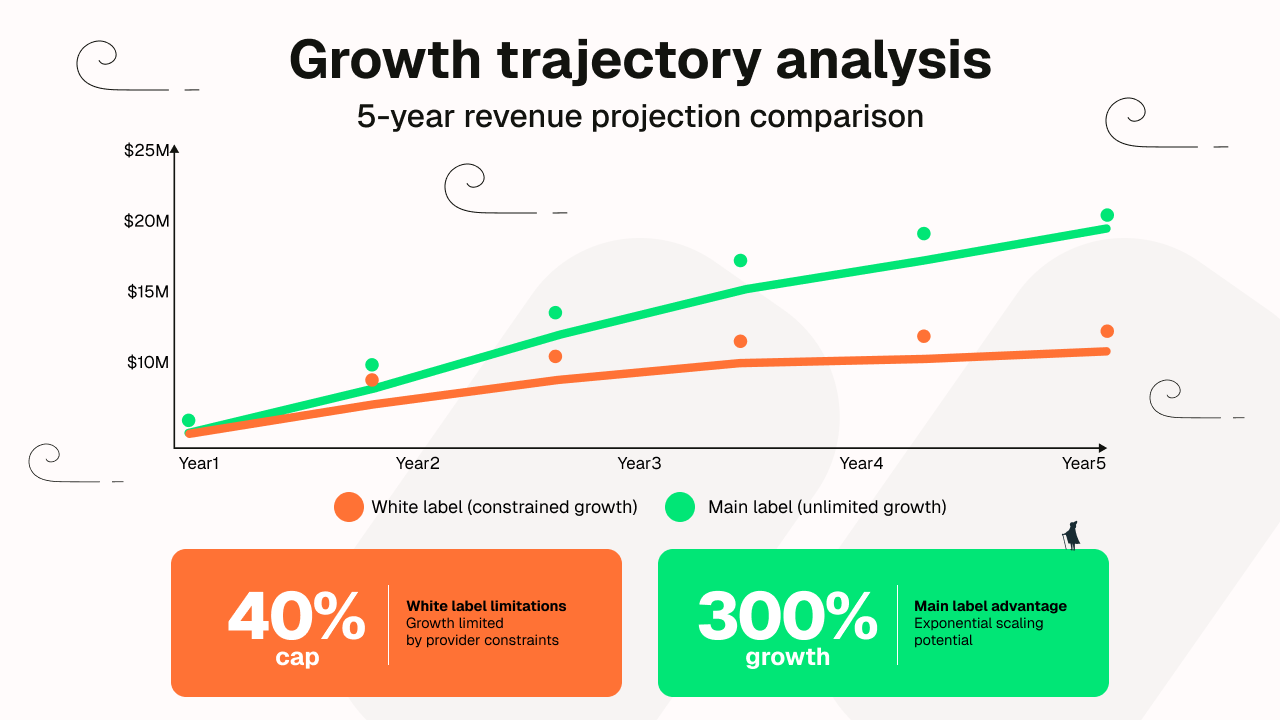

As trading volumes grow, retaining full revenue becomes the key driver of exponential business expansion. White label operators, however, lose a significant portion of their hard-earned income to technology providers who contribute nothing to client acquisition.

Over time, this loss compounds. The example below illustrates how a main label brokerage earning $10 million annually retains nearly the entire amount for reinvestment and growth, while a comparable white label operation keeps only $5–8 million - a gap that widens every year.

Ideal for: Growth-focused brokerages projecting significant volumes, operators seeking maximum return on marketing investments, and businesses planning aggressive expansion.

Strategic considerations: Requires sophisticated financial management but provides unlimited profit scaling potential.

Unlimited scalability

Main label operations remove artificial growth constraints. This enables unlimited expansion across all business dimensions. You're not bound by provider limitations on geographic expansion, asset offerings, client segments, or strategic partnerships.

Geographic expansion illustrates this clearly. Main label brokerages establish operations in new jurisdictions through direct regulatory engagement. White label operators remain confined to regions where their providers maintain licensing.

Product diversification follows similar patterns. Main label operators introduce new asset classes, develop proprietary tools, create custom solutions, and implement innovative fee structures without seeking provider approval or sharing revenues.

With cTrader's extensive API capabilities and open architecture, main label operators build sophisticated trading ecosystems optimised for their unique needs without provider restrictions.

Ideal for: Brokerages with ambitious growth plans, operators targeting multiple markets and diverse segments, and businesses requiring specialised integrations.

Strategic considerations: Demands strategic planning and sufficient capital for expansion, but removes all artificial constraints.

Operational independence

The ability to make independent decisions transforms how main label brokerages respond to opportunities and challenges. White label operators must navigate provider approval processes for significant changes. Main label brokerages implement strategic decisions immediately.

This independence manifests across all critical functions. Trading conditions, commission structures, client onboarding, risk management, technology integrations, and service offerings all fall under direct control. The result is unhindered responsiveness to market conditions.

Operational independence also enables sophisticated risk management tailored to your specific client base and business objectives. Rather than accepting one-size-fits-all parameters, main label operators develop customised frameworks optimised for their business model.

Ideal for: Brokerages targeting specific segments with unique requirements, operators in rapidly changing markets, and businesses prioritising innovative client experiences.

Strategic considerations: Requires comprehensive operational expertise but enables unlimited innovation potential.

Sustainable competitive positioning

Main label operations enable genuine differentiation, impossible under white label constraints. White label operators compete primarily on marketing and customer service within predetermined parameters. Main label brokerages differentiate across every operational dimension.

Pricing strategy exemplifies this advantage. Main label operators implement dynamic pricing models, create custom fee structures for different segments, adjust commissions based on competitive pressures, and optimise revenue generation. White label operators remain bound by provider-established frameworks.

Technology differentiation becomes equally powerful. With cTrader's customisation capabilities and advanced features, main label brokerages integrate cutting-edge analytics, develop proprietary algorithms, create custom platform features, and implement innovative solutions that provide genuine competitive advantages.

Strategic partnerships flourish under independence. Direct relationships with liquidity providers, technology vendors, payment processors, and complementary services enable alliances that strengthen market position without provider interference.

Ideal for: Brokerages in saturated markets, operators targeting sophisticated segments, and businesses seeking sustainable competitive advantages.

Strategic considerations: Requires comprehensive market analysis and strategic planning but enables unlimited differentiation possibilities.

Navigating main label challenges

Financial investment

The higher initial investment remains the most commonly cited barrier to adoption. However, a closer analysis shows it should be viewed as a strategic infrastructure investment with compelling long-term returns.

Initial costs typically include regulatory setup, platform licensing, compliance infrastructure, liquidity arrangements and operational staff - the foundational elements required to build a fully independent and scalable brokerage. While these may exceed those of a white label setup, they establish wholly owned assets rather than ongoing dependencies.

Consider the three-to-five-year trajectory. A main label brokerage’s initial investment creates owned infrastructure, enabling full profit retention. In contrast, a white label operation’s lower startup costs lead to permanent revenue sharing that compounds annually.

Break-even analysis often favours the main label within the first two years for brokerages achieving moderate trading volumes. Beyond this point, the profit retention advantage becomes exponentially more significant.

Moreover, the main label infrastructure provides strategic flexibility that white label arrangements cannot match. The ownership of technology relationships, regulatory framework, and brand position opens opportunities for business evolution, expansion and even strategic exits that multiply long-term return potential.

Strategic approach: Frame costs as infrastructure investments with measurable returns. Develop financial modelling that highlights profit retention, operational autonomy and long-term value creation.

Regulatory responsibility

Regulatory compliance under the main label operations creates significant strategic advantages when properly managed. Direct regulatory relationships enable faster approvals, customised compliance frameworks, and authentic market credibility.

The key lies in partnering with experienced platform providers who offer comprehensive regulatory support without imposing operational constraints. This delivers compliance efficiency while maintaining complete independence.

Modern regulatory technology has transformed compliance from a burden into a competitive differentiator. Advanced platforms automate reporting, monitor risk exposure in real-time, provide predictive analytics, and ensure consistent adherence to standards.

Furthermore, direct regulatory relationships position main label brokerages as credible strategic partners when dealing with institutional clients and market counterparties. This proves invaluable during regulatory evolution and licensing expansion.

Strategic approach: Invest in a sophisticated compliance infrastructure that exceeds minimum requirements. Partner with experienced platform providers who offer regulatory expertise without imposing operational constraints.

Comprehensive comparison

Criteria | White label | Main label |

Brand control | Limited customisation | Complete ownership |

Regulatory responsibility | Shared/delegated | Direct ownership |

Geographic expansion | Provider-dependent | Unlimited flexibility |

Technology integration | Provider-approved only | Best-of-breed selection |

Competitive differentiation | Limited variations | Unlimited possibilities |

Profit margins | Permanently capped | Unlimited scaling |

Time to market | 1-2 weeks | 3-6 months |

Long-term value | Operational dependency | Complete asset ownership |

Risk exposure | Shared reputation | Independent management |

Strategic partnerships | Provider-mediated | Direct alliances |

Exit strategy | Limited transferable value | High transferable value |

Strategic verdict: White label provides faster market entry with lower initial investment, but imposes permanent limitations that become increasingly restrictive. Main label requires greater initial investment but delivers superior long-term returns through complete control, unlimited profit retention, and authentic differentiation capabilities.

Conclusion: Choose independence

The choice between white label and main label determines your brokerage's competitive destiny. While white label arrangements offer convenient market entry, they impose permanent limitations on growth, profit optimisation, and competitive differentiation that become increasingly costly as your business scales.

Main label operations, particularly when supported by sophisticated platforms like cTrader, provide the essential foundation for sustainable competitive advantage. The higher initial investment transforms into exponential returns through complete profit retention, unlimited operational flexibility, and strategic independence.

For brokerages committed to long-term market leadership, maximum profitability, and unlimited growth potential, main label operations represent the only viable path to realising your full potential and building lasting market value.

The fundamental question isn't whether you can afford the initial investment in main label operations. It's whether you can afford the permanent opportunity cost and strategic constraints of white label dependencies.

Ready to unlock your brokerage's unlimited potential? Explore the main label platform licensing with cTrader and discover how operational independence drives sustainable competitive advantage and lasting market success.

FAQ

How much is cTrader?

Pricing depends on your setup, including your liquidity bridge or providers, CRMs, etc. Each case is assessed individually to ensure the best fit for your brokerage. Talk to our Sales team to learn more.

What's a realistic timeline and investment for launching a main label brokerage?

Main label deployment typically takes 3–6 months from initial planning to full launch. This process includes regulatory setup, platform integration, compliance framework implementation, staff training, and operational testing. While it requires a more structured rollout than white label solutions, it results in owned assets and direct relationships that deliver lasting returns.

How much additional working capital should I budget beyond initial setup costs?

Plan for operational capital equivalent to 12–18 months of fixed costs, including staff salaries, regulatory fees, platform licensing, and infrastructure expenses. This ensures sustainable operations while building a client base and achieving consistent trading volumes.

Can existing white label operators transition to the main label?

Yes. Client and business transition from white label to main label is entirely feasible with proper planning and execution support. The process involves regulatory coordination, platform migration (typically one day for existing client accounts), data transfer, and compliance framework development. Most clients experience improved service quality and enhanced platform features post-migration, often resulting in higher satisfaction.

What regulatory licenses do I need for main label operations?

Regulatory requirements vary by jurisdiction, target segments, and business model. Common licenses include FCA (UK), CySEC (Cyprus), ASIC (Australia), and various national authorities. Working with experienced legal and compliance advisors provides comprehensive guidance on licensing requirements, application processes, and ongoing obligations. Early regulatory planning prevents costly delays.

How do I quantify the ROI difference between white label and main label?

ROI calculation must consider profit retention differences, growth potential, and strategic value creation. Main label brokerages typically achieve positive ROI within 18-36 months due to 100% revenue retention versus 50-80% under white label arrangements. The advantage becomes exponentially more significant as volumes scale. Additionally, owned infrastructure creates substantial transferable business value, impossible under white label dependencies. Contact platform providers for customised ROI modeling based on your projected volumes and business objectives.