The prop firm landscape has undergone a dramatic transformation in recent years and has, in fact, become one of the most significant developments in the forex trading ecosystem. A proprietary trading firm (commonly known as a prop firm) represents a unique business model, one that's reshaping how entrepreneurs approach the foreign exchange markets.

These specialised companies are attracting an unprecedented number of business-minded individuals seeking to build profitable enterprises without the traditional barriers that have historically limited forex business success.

The growing trend of launching prop firms isn't merely a passing phenomenon - it's a fundamental shift that reflects changing market dynamics and evolving business opportunities, largely on the back of technological advancement. As traditional trading models face increasing scrutiny and entrepreneurs seek more sophisticated approaches to market participation, prop firms have emerged as a compelling business opportunity that offers both profitability and scalability for committed business founders.

Understanding the prop firm model is crucial for any serious entrepreneur considering their next business venture or market strategy. This comprehensive exploration will examine what makes prop firms so attractive as a business opportunity, the benefits they offer to founders, the challenges they present, and why their popularity continues to surge in today's ever-more democratic and competitive trading environment.

What is a Prop Firm?

A prop firm (short for proprietary trading firm) is a specialised educational and trading services company that provides trading education through practical evaluation programs rather than traditional client fund management.

The prop firm landscape encompasses several distinct models; however, each serves different market segments and operates under varying structures. Unlike traditional brokerage firms that earn commissions from client trades, prop firms generate profits primarily through educational program fees and evaluation services, though revenue models differ significantly across institutional, retail, in-house, and remote prop firm categories.

The infographic below highlights the annual market growth:

Types of Prop Firms

Institutional Prop Firms

These are large-scale operations typically affiliated with major banks, hedge funds, or investment firms. Institutional prop firms trade with substantial capital pools (often hundreds of millions to billions) and focus on sophisticated strategies across global markets. Traders are full-time employees with extensive experience, advanced degrees, and access to cutting-edge technology and research.

Retail Prop Firms

Retail prop firms offer trading education and skill development programs to individual traders seeking access to professional trading capital and infrastructure. Over 90% of their revenue comes from educational challenge fees, as these firms have popularized evaluation programs where traders pay for comprehensive trading assessments and skill development. These firms bridge the gap between individual retail trading and institutional-level access through structured learning programs.

In-House Prop Firms

In-house prop firms require traders to work from their physical offices, providing direct supervision, collaborative trading environments, and immediate support. These firms often offer more structured training programs and closer mentorship, but require geographical proximity and adherence to office schedules.

Remote Prop Firms

Remote prop firms allow traders to work from anywhere, leveraging technology to provide educational programs and skill assessments remotely. This model has exploded in popularity, especially post-2020, as it offers global reach and reduced operational overhead while maintaining effective performance monitoring through sophisticated evaluation systems.

Aspect | Traditional Brokerage | Institutional Prop | Retail Prop | In-House Prop | Remote Prop |

Capital source | Client funds | Firm's own capital (large scale) | Firm's own capital | Firm's own capital | Firm's own capital |

Revenue model | Commission & spreads | Direct trading profits | Challenge fees + trading profits | Direct trading profits + profit share | Challenge fees + profit share |

Trader relationship | Service provider | Employee | Client | Employee/partner | Independent contractor |

Risk bearer | Client | Firm | Firm | Firm | Firm |

Profit distribution | Fixed fees | Salary + bonus | 70-90% to trader | 50-80% to trader | 70-90% to trader |

Location requirement | N/A | Office-based | Varies | Office mandatory | Remote/global |

Capital allocation | Client determines | $500K-$50M+ per trader | $10K-$200K per trader | $25K-$5M per trader | $10K-$2M per trader |

Profit-Sharing Models Across Prop Types

Most prop firms institute profit-sharing systems, but the percentage varies significantly by firm type:

- Institutional props typically offer 10-30% profit splits to traders, focusing instead on competitive salaries and performance bonuses

- Retail prop firms commonly provide 70-90% profit splits to successful program graduates, with higher percentages for larger account sizes or proven track records

- In-house props often range from 50-80% profit splits, balancing the overhead of physical infrastructure with competitive compensation

- Remote props generally offer 70-90% splits similar to retail props, leveraging lower operational costs to provide attractive terms to successful graduates.

The profit-sharing arrangement depends on factors including the firm's operational model, trader experience level, capital allocation size, and the specific risk management framework employed.

For entrepreneurs considering this business model, understanding forex trading risk management principles becomes essential when developing operational frameworks, particularly when choosing between in-house supervision and remote monitoring systems that can effectively manage educational program delivery and graduate performance tracking.

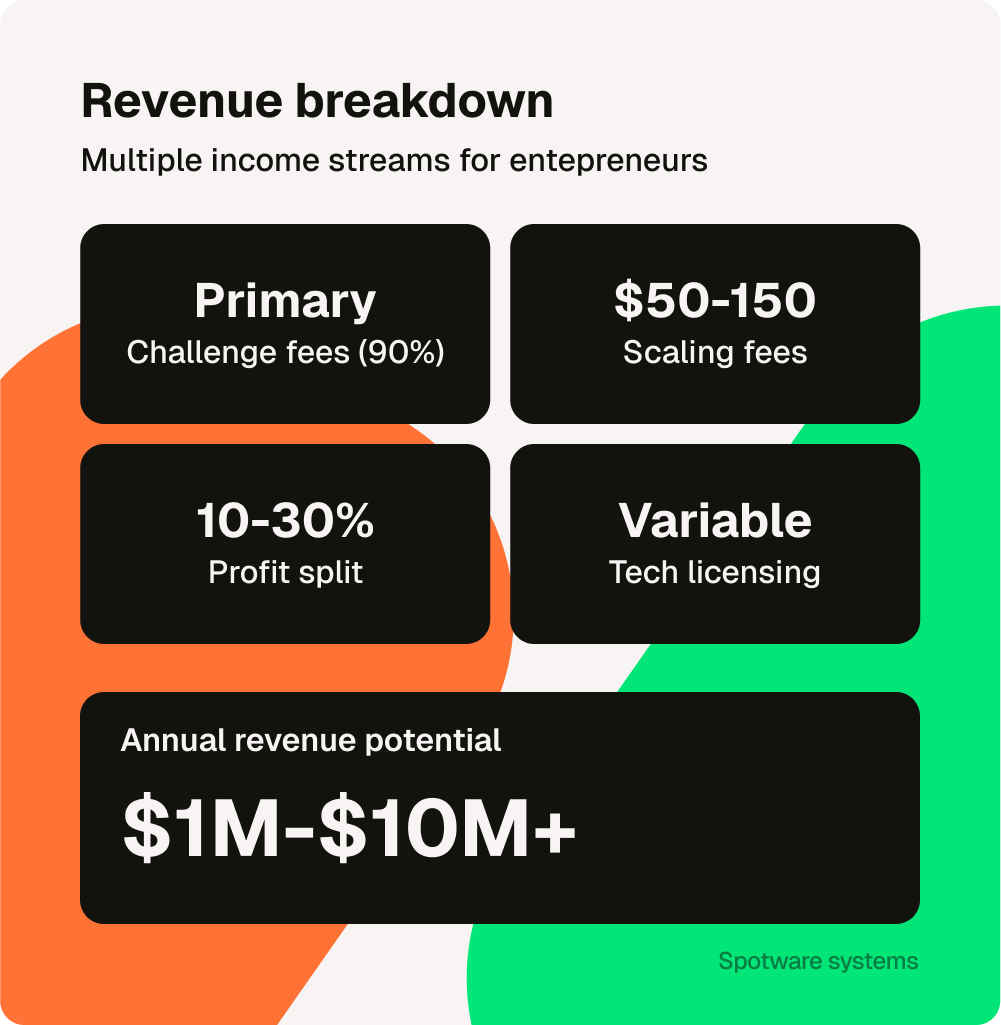

While revenue streams can be diverse (as shown above), one of the most critical variables for both firms and traders is the profit-sharing model:

How Prop Firms Operate

Prop firms employ sophisticated operational models designed to maximise educational effectiveness and business sustainability while managing risk exposure, though these frameworks vary significantly across institutional, retail, in-house, and remote prop firm structures. Understanding these operational differences is crucial for both aspiring traders and potential firm founders.

Recruitment Process Variations

Institutional Prop Firms:

- Extensive background checks and advanced degree requirements

- Multi-stage interviews with senior traders and risk managers

- Quantitative assessments and coding challenges for algorithmic roles

- Focus on experience at tier-1 financial institutions

Retail & Remote Prop Firms:

- Standardized educational challenges and skill assessment procedures

- Comprehensive evaluation programs testing risk management and consistency

- Merit-focused educational approach accessible to individual traders globally

- Progressive skill development through structured learning phases

In-House Prop Firms:

- Local recruitment with emphasis on personality fit and coachability

- In-person interviews and trial trading periods

- Assessment of ability to work in collaborative environments

- Geographic proximity requirements for office attendance

Training & Development Models

Institutional Approach:

- Formal apprenticeship programs lasting 6-24 months

- Access to proprietary research and institutional-grade market data

- Mentorship from senior portfolio managers and quantitative analysts

- Structured career progression with clear advancement metrics

Retail/Remote Approach:

- Comprehensive online educational programs tailored to practical trading skills

- Technical analysis workshops and risk management training

- Trading psychology education with experienced mentors

- Continuous skill development through webinars and market analysis

In-House Approach:

- Daily morning meetings and real-time collaboration

- Immediate feedback and hands-on coaching

- Group learning sessions and peer knowledge sharing

- Direct access to senior traders for instant guidance

Risk Management Protocols by Firm Type

Institutional Risk Controls:

- Enterprise-level risk management systems with real-time P&L monitoring

- Sophisticated VAR (Value at Risk) models and stress testing

- Capital allocation based on complex risk-adjusted return metrics

Retail/Remote Risk Controls:

- Position sizing limits and daily loss restrictions within educational frameworks

- Maximum drawdown controls typically range from 5-12% during evaluations

- Automated monitoring systems and account management protocols

- Real-time performance tracking through cloud-based educational platforms

In-House Risk Controls:

- Direct supervision with immediate intervention capabilities

- Collaborative risk assessment and peer oversight

- Physical presence enabling instant communication during volatile markets

- A combination of automated systems and human oversight

Technology & Execution Differences

Institutional Firms:

- Direct market access (DMA) and co-location services

- Proprietary trading platforms and algorithmic execution systems

- Ultra-low latency connections and institutional liquidity providers

Retail/Remote Firms:

- Enhanced market access with institutional-grade execution for qualified graduates

- cTrader, or proprietary web-based platforms for educational delivery

- Competitive spreads and execution speeds suitable for educational and live trading

In-House Firms:

- Professional trading setups with multiple monitors and a dedicated internet connection

- Shared infrastructure reduces individual technology costs

- Immediate technical support and platform maintenance

Capital Allocation & Scaling Models

The educational progression and capital access procedures vary significantly among prop firm types:

Institutional: Start with $100K-$1M+ allocations, scaling based on risk-adjusted returns and institutional performance metrics.

Retail/Remote: Begin with educational challenges, progressing to $10K-$200K simulated accounts for skill development, with potential advancement to funded accounts for exceptional graduates, providing increased funding based on demonstrated consistency and adherence to risk parameters.

In-House: Typically start with $25K-$250K allocations, with rapid scaling potential due to direct supervision and immediate performance feedback.

As a prop firm founder, your operational model choice will fundamentally determine your educational delivery strategy, technology requirements, and student assessment complexity. Many successful institutional prop firm founders study traditional hedge fund operations, while retail prop firm founders often focus on scalable technology solutions and automated educational management systems that can handle distributed program delivery effectively.

The Benefits of Starting a Prop Firm

Benefit | Description | Impact on Business |

Scalable Educational Revenue | Multiple income streams from educational programs and skill assessments | Diversified profit potential with predictable revenue |

Risk Management | Controlled exposure through systematic protocols | Predictable business outcomes |

Technology Leverage | Professional platforms & infrastructure | Competitive advantage |

Educational Market Opportunity | Growing demand for professional trading education and skill development | Expanding target market |

1. Scalable Revenue Streams

As shown in the infographic above, the prop firm model combines multiple scalable revenue streams with low overhead. Here’s how these elements translate into a sustainable business.

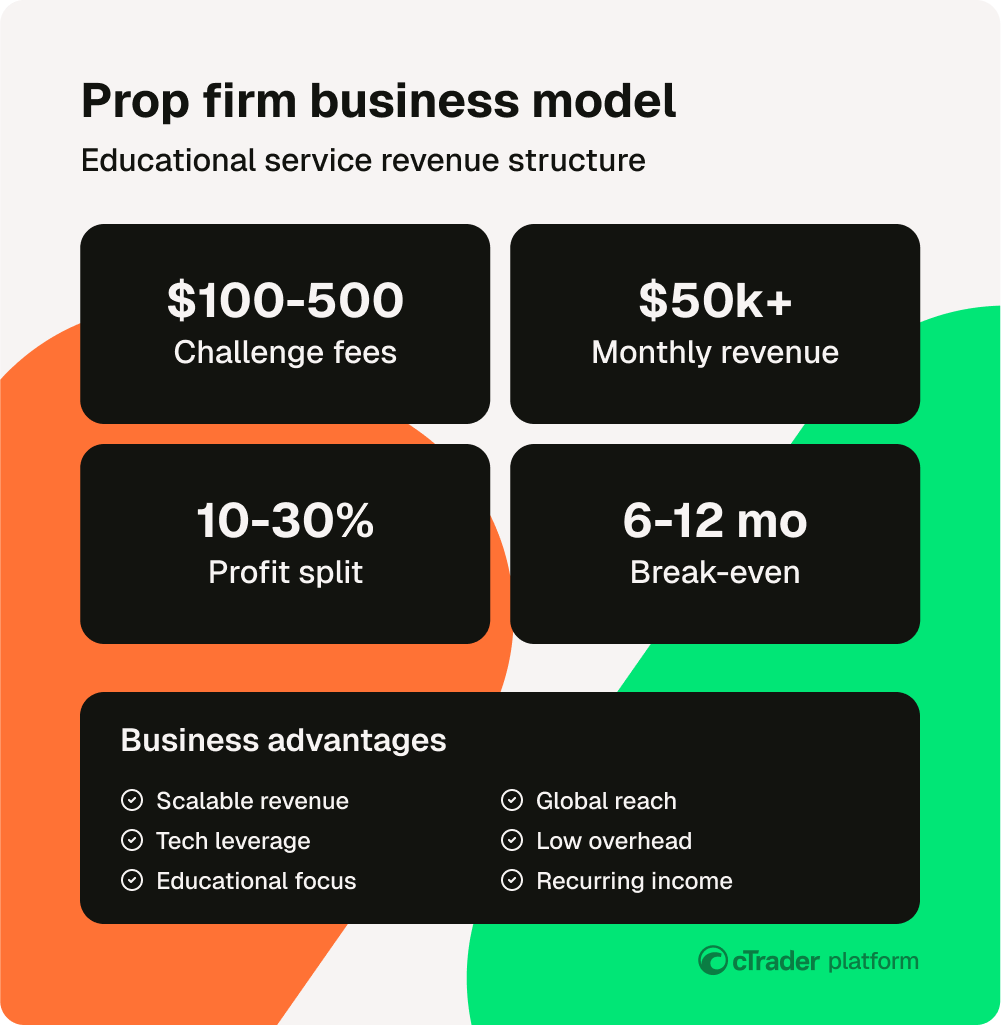

The primary attraction of prop firms as a business lies in their ability to generate multiple educational revenue streams that scale independently. Most retail prop firms earn substantial income through educational challenge fees, which can range from $100 to $500 per assessment program, with successful firms processing hundreds of educational enrollments monthly. This creates predictable recurring revenue that focuses on educational service delivery rather than trading performance dependency.

Additionally, the profit-sharing model with successful program graduates provides a performance-based revenue stream that grows as your educational community expands. Unlike traditional businesses that require linear scaling of resources, prop firms can multiply their earning potential by developing comprehensive educational programs and graduating skilled traders. The business model essentially democratises access to professional trading education while creating sustainable profit margins for founders.

Furthermore, prop firms benefit from enhanced market access and institutional relationships that individual entrepreneurs rarely achieve independently. These partnerships often lead to improved execution, better pricing, and additional revenue opportunities through technology licensing or white-label services.

When evaluating different technology solutions for your prop firm, understanding forex trading platforms helps in selecting the optimal infrastructure for your business.

2. Controlled Risk Environment

Operating a prop firm provides entrepreneurs with a controlled risk environment compared to other financial ventures. The educational business model allows founders to implement sophisticated assessment protocols that generate consistent revenue while managing capital exposure. Through systematic evaluation criteria, automated monitoring, and performance-based progression systems, prop firm founders can maintain predictable risk parameters.

This educational focus has significant business advantages that improve overall profitability. Entrepreneurs operating prop firms typically experience more stable cash flows and can make strategic decisions without the volatility associated with traditional trading businesses. The separation between educational revenue and trading performance allows founders to focus on systematic growth and operational optimisation.

Many successful prop firms provide business stability through diversified educational programs, structured assessment management that ensures consistent revenue flow, and scalable technology systems that support growth without proportional cost increases. Focus on educational excellence and systematic skill development with firms that prioritise systematic success. Platforms like cTrader offer real-time assessment and monitoring tools that make maintaining educational program standards easier.

3. Technology and Infrastructure Advantages

Moreover, prop firms benefit from institutional-grade technology and infrastructure that individual educational businesses rarely access independently. Key technological advantages include:

- Professional trading platforms with advanced execution and real-time educational monitoring capabilities

- Comprehensive assessment systems that automate evaluation protocols and progress tracking

- Scalable educational infrastructure through cloud-based solutions and automated processes

- Data analytics capabilities providing detailed learning insights and program optimisation opportunities

This technological component is particularly valuable, as prop firm founders can leverage professional-grade infrastructure without the massive capital investment typically required. The technology accelerates business development and helps founders avoid costly operational mistakes that can take years to rectify independently. Understanding advanced educational delivery techniques becomes more accessible through professional platform partnerships.

4. Market Positioning Opportunities

The collaborative environment within the prop firm industry creates valuable positioning opportunities that extend far beyond individual business activities:

- Industry partnerships with technology providers, educators, and service companies

- Market credibility through professional operations and educational service delivery

- Business development opportunities leading to joint ventures and strategic alliances

- Professional network expansion during industry events and business conferences

Many successful prop firm founders leverage their industry connections to expand into related businesses, secure better technology deals, or develop proprietary solutions for the broader market.

The business community aspect provides strategic insights and shared experiences that help entrepreneurs maintain competitive advantages and market perspective during inevitable industry changes - something isolated business founders rarely experience, regardless of their individual expertise.

The Challenges of Starting a Prop Firm

1. Capital Requirements and Educational Program Development

While educational challenge fees provide the primary revenue stream for retail prop firms, they also represent substantial program development requirements compared to other business models. Successful prop firm founders must develop comprehensive educational content and assessment frameworks to attract skilled traders, which requires significant initial investment in curriculum development and technology infrastructure and ongoing educational program enhancement.

The challenge fee structure creates ongoing operational commitments that must be carefully managed. Entrepreneurs must evaluate these arrangements against projected returns and consider how they impact business cash flow and growth financing. Additionally, some business models require complex operational structures that can increase administrative costs through educational content management, technology, or program compliance requirements.

The educational service model also means that business growth depends heavily on program quality and student satisfaction. Unlike traditional businesses where founders control all variables, prop firm success requires effective educational content development and student experience management, which can be challenging for new entrepreneurs.

2. Technology and Operational Complexity

Prop firms require sophisticated technology infrastructure and operational procedures to remain competitive in today's market, which can present a steep learning curve for new business founders. These requirements include professional trading platforms, educational assessment systems, performance monitoring tools, comprehensive evaluation software, and customer relationship management solutions that integrate seamlessly—not because of regulatory mandates, but because serious traders expect institutional-grade educational infrastructure.

While these systems serve essential competitive functions, they require significant technical expertise and ongoing maintenance that goes beyond typical business operations. Some entrepreneurs find this operational sophistication more demanding than anticipated and may underestimate the technical requirements, although many discover that robust systems become the foundation for sustainable scaling and market differentiation.

The performance monitoring and educational program management requirements needed to deliver high-quality training services can feel overwhelming to founders accustomed to simpler business models. Detailed analytics, real-time assessment monitoring, and systematic educational reporting are standard expectations in the prop trading industry, requiring systematic approaches that not all entrepreneurial personalities find appealing or intuitive.

However, it's noteworthy that sophisticated operational monitoring should be part of any scalable business approach, so the advanced systems common in prop firm environments often develop better business operators of founders, and these are the entrepreneurs who build the most successful and competitive firms.

The key challenge isn't regulatory compliance - it's meeting the professional educational standards that serious traders demand in an increasingly competitive market.

3. Educational Program Quality and Student Management

Managing educational programs and student progression represents a unique challenge for prop firm founders. The business model requires maintaining high educational standards while managing the reality that comprehensive skill development takes time and not all students will progress to advanced levels. Founders must balance rigorous assessment criteria with supportive learning environments, ensuring that educational programs provide genuine value while maintaining business sustainability.

This educational focus requires specialized expertise in curriculum development, student psychology, and progressive skill assessment that many traditional business founders lack. The success of the business depends on creating educational experiences that students perceive as valuable and fair, regardless of their individual outcomes.

Why More Entrepreneurs are Starting Prop Firms

1. Market Access and Democratisation

Prop firms are democratising trading education and professional development by making professional-level educational programs accessible to entrepreneurs who lack traditional financial industry connections. This accessibility has opened business opportunities to individuals who previously couldn't access institutional markets, including technology entrepreneurs, international business founders, and professionals transitioning from other industries.

The barrier to entry for educational service businesses is increasingly reasonable compared to traditional financial services. While other financial businesses often require extensive regulatory approvals and capital reserves, educational prop firms can demonstrate business viability through technology solutions and program effectiveness rather than just financial resources. This merit-based approach attracts talented entrepreneurs who can prove their business capabilities through systematic development.

Many prop firms now offer remote educational models, further expanding business accessibility by eliminating geographical limitations. This approach means entrepreneurs can build leading educational service businesses regardless of their location, provided they can demonstrate program excellence and market understanding.

2. Evolving Technology Landscape

Technological advancement has significantly improved the prop firm business model, making it more attractive and accessible than ever before. Modern trading platforms and educational delivery systems, risk management systems, and operational tools enable prop firms to operate efficiently while providing institutional-quality services.

The evolution of business processes has also made prop firm operations more streamlined. Many technology providers now offer comprehensive solutions and integrated systems that allow entrepreneurs to focus on business development without extensive technical expertise. These solutions have reduced the complexity associated with starting educational service businesses.

Furthermore, the increasing sophistication of online education and remote work has created a larger pool of qualified candidates for educational programs. As more individuals seek professional trading skills through digital education, they become suitable clients for educational services, creating mutually beneficial business relationships.

Usually, it takes around 5 days for prop firms to incorporate cTrader into their business. With streamlined processes and expertise, technology providers ensure the most efficient onboarding experience for new prop firm founders.

3. Business Model Innovation

The innovative aspects of prop firm business models appeal to entrepreneurs who value scalable systems and educational service delivery. Many business founders find traditional models limiting and prefer the dynamic aspects of building comprehensive training programs.

Prop firms facilitate systematic business growth through structured approaches, including operational standardisation, educational performance measurement systems, technology integration, and scalable program delivery processes. This systematic approach accelerates business development and helps entrepreneurs build more robust enterprises through exposure to proven methodologies.

The business model also provides accountability and strategic focus that many independent entrepreneurs lack. The educational service nature, systematic goals, and measurable outcomes within prop firms create an environment that encourages consistent business development and professional growth.

Why cTrader for Your Prop Firm Business?

When evaluating technology solutions for your prop firm, the trading platform foundation can significantly impact your business success and operational efficiency. Prop firms that build on cTrader's advanced platform infrastructure give their businesses a distinct competitive advantage through superior execution speeds, institutional-grade technology, and an intuitive interface designed specifically for professional forex operations.

A prop firm offering cTrader is automatically positioned as trustworthy because the platform protects traders from price manipulation, stop-loss hunting and non-transparent deals, ensuring prop firms remain accountable to their clients. This transparency builds crucial market credibility for new businesses and is crucial in the unregulated landscape of forex prop firms today.

Unlike basic retail solutions, cTrader offers business founders the sophisticated infrastructure typically reserved for institutional environments—including advanced operational tools, comprehensive business analytics, and seamless integration capabilities. For prop firm entrepreneurs who need to demonstrate operational excellence under competitive pressure, these professional-grade features can make the difference between business success and failure.

cTrader is already integrated with over 100 popular FX/CFD solutions, including CRMs, and integrating a custom backend operational system is straightforward using available APIs such as WebServices API, Manager’s API and Reporting API. It’s this robust integration capability that reduces operational complexity and accelerates business launch timelines.

Smart entrepreneurs prioritise technology solutions that offer cTrader's comprehensive business infrastructure, because the platform's reliability, scalability, and advanced operational tools directly translate to better business outcomes. When your prop firm's success depends on operational precision and professional-level market infrastructure, choosing technology that provides access to cTrader's cutting-edge platform gives you the foundation necessary to maximise your business potential. Book a demo to see how cTrader can accelerate your prop firm launch.

Conclusion

The prop firm model represents a compelling evolution in trading education and financial services that addresses many limitations faced by individual entrepreneurs seeking market-based business opportunities. By providing scalable educational revenue streams, controlled risk environments, advanced technology access, and structured program delivery frameworks, prop firms have established themselves as attractive alternatives to traditional financial service businesses.

While challenges exist, including program development requirements and operational demands, many entrepreneurs find these considerations manageable in exchange for the opportunities prop firms provide. The growing popularity of prop firms reflects their ability to meet the needs of modern business founders who seek systematic growth, technology leverage, and educational service success.

As the forex market continues evolving, prop firms are likely to play an increasingly important role in trading education and professional development. The model's flexibility, scalability, and focus on educational excellence align well with current business trends and entrepreneurial expectations. For many professionals, prop firms offer the optimal balance between opportunity and systematic growth necessary for long-term business success.

The future of trading education may well be shaped by the continued growth and evolution of prop firms, making them an essential consideration for any serious entrepreneur evaluating educational service opportunities and growth strategies.

Indeed, prop firms may well prove to be the ultimate business opportunity when applied to the education-focused realities of modern financial services, one that separates committed entrepreneurs from casual business dabblers, and makes prop firm businesses the default choice for ambitious founders in the coming years.

FAQ

What capital do I need to start a prop firm?

Starting capital varies significantly, but most successful educational prop firms begin with $50,000-$200,000 for operational expenses including technology, program development, and business infrastructure. The educational service model requires less trading capital than traditional financial businesses.

How profitable are prop firm businesses?

Profitability depends on educational program quality and student enrollment success. Successful educational prop firms typically achieve 15-40% annual returns on invested capital through challenge fees and supplementary profit-sharing arrangements.

What regulatory requirements apply to prop firms?

Forex prop firms currently operate as educational service providers, with all skill assessments conducted on demo accounts. Since they provide educational services rather than manage client funds, they fall outside of traditional financial regulation.

How long does it take to build a profitable prop firm?

Most prop firms achieve profitability within 6-18 months, depending on initial capital, technology infrastructure, and educational program effectiveness and student acquisition. Systematic business development typically accelerates this timeline.

What technology infrastructure do prop firms need?

Essential systems include professional trading platforms, educational assessment software, performance monitoring tools, comprehensive evaluation systems, and customer relationship management solutions. Integration capabilities and scalability are crucial for growth.

How do I build effective educational programs for my prop firm?

Effective educational programs combine systematic skill assessment procedures, comprehensive training materials, progressive development frameworks, and strong operational support. Building industry reputation through educational excellence accelerates quality student acquisition.

What makes prop firms different from hedge funds?

Prop firms focus on trading education and skill development through practical programs, while hedge funds manage investor money through portfolio strategies. Prop firms emphasise individual educational progression, while hedge funds focus on systematic investment approaches.

Can prop firms operate internationally?

Yes, many prop firms operate globally through remote educational technology solutions. There is currently no oversight from forex regulators—they operate as educators under current rules. All challenges occur on demo accounts, and even 90% of 'funded account' trading uses B-book methods, leveraging the capital collected from challenge fees.

How important is the choice of trading platform for prop firm success?

Platform selection significantly impacts operational efficiency, student satisfaction, and business scalability. Professional platforms like cTrader provide institutional-grade infrastructure that supports business growth and competitive positioning in educational service delivery.