Launching a proprietary trading firm is exciting, but the first decision is how much capital to risk. In practice, firms do not hand new participants large live accounts straight away. Candidates begin in demo environments, proving consistency under strict rules, and only then is real capital introduced and scaled gradually. The business model relies on evaluation fees as a primary revenue stream, covering operating costs and payouts. Those who demonstrate consistent performance can progress to simulated payouts, hybrid trade mirroring, or direct funding under defined limits, where the firm also retains a share of profits.

In reality, successful prop firms grow by applying structured risk models that expand exposure gradually. Performance is tested in controlled environments first, risk is contained through strict limits, and capital is only deployed once consistency is proven. This step-by-step model protects the firm while rewarding disciplined and methodical performers.

Technology plays a central role in making this work. With cTrader Admin, firms can enforce trading rules transparently and at scale through Groups and group profiles. At the same time, bulk force-close capabilities enable managers to manage risk effectively and respond promptly during volatile market conditions. In critical moments, managers can force-close positions or cancel pending orders instantly to protect capital, all while maintaining full visibility and data integrity. The platform also streamlines account management - allowing teams to transfer account settings, adjust balances and apply group profiles efficiently across multiple accounts and user types.

Additionally, administrators can manage and create new assets, ensuring a flexible configuration for evolving trading programs. These capabilities allow prop firms to operate smoothly, maintain transparency, and manage trader environments with precision.

This article examines how modern prop firm risk models operate, particularly when real money is at stake and why cTrader’s automation and transparency tools have become the backbone of leading firms worldwide.

Why does this question matter to prop firm owners?

Imagine a common scenario. A new firm launches with 500 traders paying to join evaluation challenges. If those traders were given live accounts without strict limits, even a handful of reckless positions could create losses large enough to wipe out the firm’s capital in days. In practice, many firms avoid this risk by using simulated accounts during evaluations, where no real funds are exposed. The true danger comes if a firm moves too early into live funding without applying clear risk controls. Furthermore, trust among traders can vanish quickly if payouts are delayed or rules appear inconsistent.

This structure turns a potential collapse into a predictable, controlled growth path - evaluation fees cover costs, only proven traders get funded and firm capital is preserved for long-term sustainability.

The evaluation stage - revenue first, risk later

The evaluation stage is the foundation of most modern prop firms. Instead of committing live funds immediately, firms place traders on simulated, or demo, accounts that mirror real market conditions. Spreads, liquidity, and execution speed are identical to a live environment, but no orders reach the market.

This stage is not just a filter; it is a business model in itself. Evaluation fees create a steady income stream that covers platform costs, payouts and staff, while simultaneously stress-testing traders under realistic conditions. Many firms report that more than 80% of traders never progress beyond this stage, meaning the evaluation cycle itself is what sustains the company’s balance sheet.

The objectives of the evaluation are clear:

- Discipline check - does the trader follow daily loss rules or try to double down after losses?

- Strategy consistency - are trades random, or do they show a repeatable edge across weeks of activity?

- Risk behaviour - how much exposure does the trader take relative to account equity?

- Psychological resilience - can the trader handle drawdowns without panicking or breaking rules?

With cTrader Admin, firms gain full transparency and control rather than relying on rigid, pre-set automation. Trade receipts capture every order event, instance of slippage, and Level 2 snapshot, giving managers the insight they need to act consistently and fairly. Using cTrader’s APIs, firms can also connect their internal systems - from CRMs to proprietary tools - to automate key workflows such as trade closures, daily loss alerts and large-scale account management.

Two capabilities stand out in particular:

- Behavioural monitoring currently identifies multiple identities, helping firms detect rule-bypassing activity early. Broader pattern-recognition features - including detection of cross-account hedging and martingale behaviour - are planned for future releases.

- CRM and payment integrations can be built through cTrader’s APIs, enabling firms to link their systems and automate onboarding. Traders can sign up, complete KYC, make payments, and receive evaluation credentials seamlessly - with minimal manual involvement from the firm’s team.

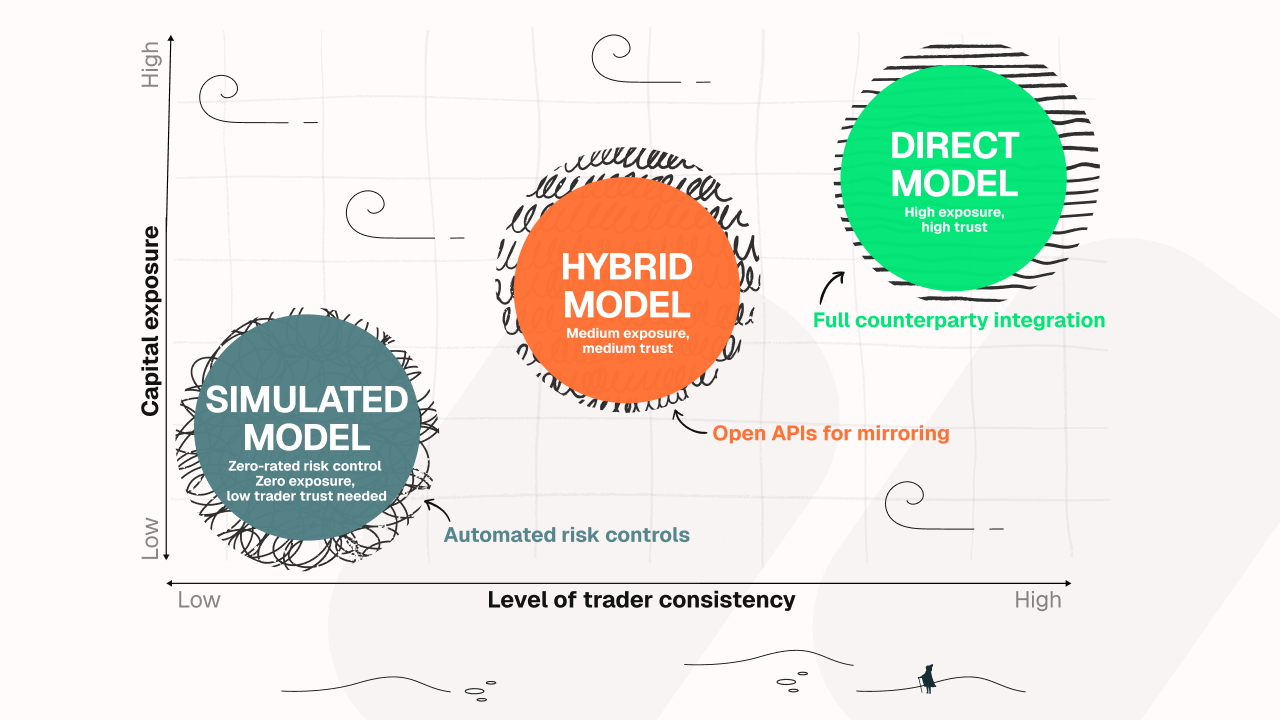

Funding stage risk models

Simulated and payout model

In this model, traders continue on simulated, or demo accounts, but any payouts are funded directly from firm revenues, typically generated through evaluation fees. No trades are executed in the market, which means the firm carries zero trading risk.

With cTrader’s account management system, firms can enforce all risk conditions automatically. High-leverage settings are possible without capital danger, and bulk operations allow managers to oversee hundreds of accounts efficiently. Granular access controls and detailed reporting provide full oversight, while payout logic is integrated seamlessly.

Benefit to firm owners: predictable scaling with limited capital exposure, provided payout obligations remain aligned with evaluation fee revenues.

Hybrid or trade mirroring model

In this model, firms selectively copy trades from consistent performers into live accounts connected to liquidity providers. This creates an additional profit stream, while strict limits keep risk under control.

Through cTrader’s Manager's API, exposure can be scaled dynamically. Managers can define position sizes, apply leverage caps and monitor execution quality in real time. In practice, many firms mirror trades in small, incremental allocations rather than full exposure, which helps keep drawdowns manageable. Many also choose to mirror only a subset of instruments or strategies to reduce correlation risk across accounts.

Benefit to firm owners: profitability aligns directly with trader success, while exposure remains limited and oversight remains strict.

Direct real-money accounts

This model is reserved for very disciplined traders, but in practice, very few firms grant full direct access to funded accounts. More commonly, limited capital is allocated through master accounts with strict parameters for position sizes, daily losses, and maximum drawdowns. This ensures exposure remains controlled, even at the highest funding levels.

The main risk for firms is not the allocation itself but under-enforcing rules. If drawdown or loss caps are overlooked, payouts can exceed evaluation revenues and destabilise the business model. For this reason, direct funding must always be supported by strict oversight and transparent execution reporting.

With the cTrader Admin 9.6 release, risk management goes further:

- Managers can bulk force-close positions and cancel all pending orders instantly during volatile situations, preserving capital.

- A new Sessions app tracks every trader login with IP, account and device details, making monitoring more transparent.

- Account management capabilities - including the ability to transfer account settings, adjust balances, and apply group profiles across large numbers of users - ensure operational efficiency at scale.

Benefit to firm owners: capital can be deployed with confidence, supported by automated controls, transparent reporting and institutional-grade oversight.

Why these models work for firm owners

The funding models used by many prop firms are not theoretical. They are built to solve real business problems: how to grow revenue, protect capital and maintain credibility.

Capital preservation: real money is never the starting point. Traders are first tested on evaluation accounts, which are risk-free for the firm but structured to closely mimic live trading conditions. This balance is key to maintaining credibility with traders while ensuring only those with consistent results move forward. By filtering performance at this stage, firms avoid the sudden large losses that can occur if inexperienced traders are given direct access too early.

Sustainable scaling: evaluation fees provide not only a predictable cash flow but also the pool from which trader payouts are funded. This helps the model remain balanced as payouts grow, though firms must actively manage the relationship between evaluation fee income and payout obligations to maintain long-term sustainability. Hybrid models create an additional income opportunity by allowing firms to mirror selected trader activity, gaining from profitable performance when it occurs while keeping overall exposure under control. Together, these elements allow firms to expand in a way that is driven by revenue rather than by exposing company reserves.

Automation with cTrader: With cTrader Admin, firms gain full transparency and the flexibility to act consistently rather than relying on rigid automation. Recent updates strengthen this further: managers can bulk-cancel pending orders in volatile markets, navigate large datasets faster with caching, and track trader activity through the Sessions app with detailed session IDs, IPs, and accounts.

The addition of free account functionality also enables prop firms to run trading competitions or internal challenges efficiently and at scale. For prop firm owners, these tools reduce manual workload, prevent operational bottlenecks, and ensure risk and trader behaviour are visible and enforceable across the entire business.

Trust and credibility - Detailed trade receipts provide firms with transparent, verifiable records of execution quality, including order flow, slippage, and Level 2 market data. This level of transparency reinforces a firm’s reputation for fairness and precision, strengthening relationships with liquidity providers, technology partners and other industry stakeholders. Over time, consistent transparency supports compliance, strengthens brand credibility and attracts professional traders who value reliable execution environments.

In practice, these models mean a firm can launch with thousands of evaluation traders, pay out profits confidently and only allocate real funds to the very few who prove they can handle them. The result is a business that grows predictably while capital remains protected.

Regulatory requirements vary by jurisdiction and by the firm’s model (simulated (i.e., demo), hybrid, or live). Firms should seek professional legal advice before offering funded trading accounts, as certain setups may fall under financial or derivatives regulations such as CFTC/NFA in the U.S. or MiFID in the EU.

Key takeaways for founders and executives

- Real money comes later. Prop firms do deploy live funds, but only after traders prove consistency. All evaluation accounts are simulated at the start, meaning no firm capital is at risk until a trader qualifies. This ensures the balance sheet stays protected while only proven performers advance. At every stage - from demo to live - cTrader Admin provides the same robust management environment, giving firms rich functionality and consistent oversight across both simulated (i.e., demo) and real accounts.

- Simulated + payout is the safest entry point. Not every firm begins with this model, but for new entrants, it is the most sustainable and risk-aware approach. It offers a scalable path to revenue through evaluation fees while keeping firm capital protected from direct market exposure. Hybrid mirroring or direct live accounts can be introduced later, once systems and oversight are firmly in place.

- Technology makes rules enforceable. With cTrader Admin, firms gain full transparency and control rather than relying on rigid, pre-set automation. Using cTrader’s APIs, firms can design their own workflows to close trades, trigger daily loss alarms and manage accounts at scale. Two areas stand out: behavioural monitoring, which currently helps identify multiple identities - with broader detection capabilities such as recognising cross-account hedging or martingale patterns planned for future releases; and CRM and payment integrations, which can be implemented through cTrader’s APIs, allowing firms to connect their own systems and automate onboarding so traders can sign up, complete KYC, make payments and receive credentials with minimal manual involvement.

- Professional execution builds credibility. A transparent, branded platform signals reliability to traders and partners. This credibility is often the difference between attracting hobby traders and building a community of serious, long-term performers.

Conclusion

Many prop firms succeed not by giving away capital, but by enforcing disciplined risk models that scale exposure only when traders prove themselves.

Launching a proprietary trading firm is more about disciplined risk frameworks and scalable technology than about immediate live capital. It requires the right tools to manage risk effectively and a reliable platform to execute with precision.

With cTrader and its fully functional, risk-aware back office, cTrader Admin, firms gain professional-grade execution, automated risk controls, and comprehensive account management across both demo and live environments. Together, these tools give firms the scalability to grow sustainably while protecting capital and building trust with traders and partners.

Talk to our team to explore how cTrader can support your prop firm’s risk and technology setup.

FAQ

Do prop firms really use real money?

Yes, but not from the start. Most traders begin on simulated, or demo accounts where no live funds are at risk. Real capital is only allocated once a trader proves consistent performance under strict rules.

Why don’t firms give live money immediately?

Because it exposes the firm to unnecessary risk. By testing traders on simulations first, firms protect their balance sheet while generating revenue from evaluation fees.

How do prop firms make money if traders are on demo accounts?

The main revenue stream comes from evaluation fees, which cover operating costs, trader payouts, and future funding allocations. Since only a portion of traders advance beyond evaluations, the model remains balanced. In addition, hybrid trade mirroring can provide another income stream, allowing firms to benefit from trader performance without taking on full exposure.

What is the simulated and payout model?

Traders stay on demo accounts, and profit payouts are funded from the firm’s revenues - not directly from live market trades.

What is hybrid trade mirroring?

In this model, the firm selectively copies trades from consistent traders into live brokerage accounts. Profits are shared, but exposure is capped. This aligns firm profitability with trader success.

What are direct real-money accounts?

These are reserved for elite traders who have shown long-term consistency. They gain access to live brokerage accounts but remain under strict rules such as daily loss caps, drawdowns and position size limits.

How does cTrader support prop firms at each stage?

- Evaluation stage + Detailed trade receipts: give firms transparent, verifiable execution data, including order events, slippage and Level 2 market information. This transparency strengthens internal evaluation processes and reinforces the firm’s credibility with clients and partners by demonstrating that all trades are recorded and assessed accurately. Through cTrader’s APIs, firms can connect in-house systems or CRMs to set up workflows for rule enforcement, such as daily loss alarms or automated account closures, ensuring every stage of the evaluation is consistent and auditable.

- Simulated + payout model - Supports large-scale account management with bulk operations, integrated payout logic and CRM/payment integrations that streamline onboarding and reduce manual work.

- Hybrid mirroring - Uses Open API to enable selective, controlled trade copying into live accounts. Firms can mirror trades in small allocations, limit exposure and reduce correlation risk by choosing which instruments or strategies to copy.

- Direct funding - Ensures discipline with Detailed trade receipts that capture slippage, order flow and execution times, allowing firms to hold traders accountable. New features (bulk cancellation of pending orders, Sessions app for tracking logins, caching for smoother navigation and symbol-split chart updates) add further oversight and operational efficiency.

What new features has cTrader Admin recently added?

Managers can bulk force-close positions or cancel pending orders in volatile markets and track trader logins through the Sessions app. The platform now also supports easier demo account management - transferring settings, adjusting balances, and applying group profiles - plus tools for creating and managing new assets.

Recent updates in versions 9.7 and 9.8 further enhance transparency and risk control with:

- Free accounts enabling prop firms to run trading competitions or internal challenges

- Updated margin calculations with open positions

- Colour labelling for accounts and groups

- Grouping sessions by properties

Why is transparency so important for prop firms?

Because trust drives growth. Traders need confidence that execution is fair, while partners and liquidity providers require evidence of strong oversight. Transparent reporting and trade receipts deliver this credibility.

What is the safest funding model for new firms?

The simulated and payout model. It requires no live capital, generates income from evaluations and can scale without exposing the firm to reckless risk.

Do I need millions to launch a prop firm?

No. What you need is the right risk model and the right platform. With cTrader, firms can scale sustainably, enforce rules automatically and protect both their reputation and their capital.