The algorithmic trading landscape has fundamentally shifted. Where traders once cobbled together bots from scattered forums and untrusted sources, cTrader Store now connects over 11 million traders worldwide to a secure marketplace of verified trading algorithms, indicators, copy strategies and Plugins. For brokers and prop firms, this represents a strategic growth lever that transforms how you engage clients, monetise your ecosystem and expand your competitive positioning.

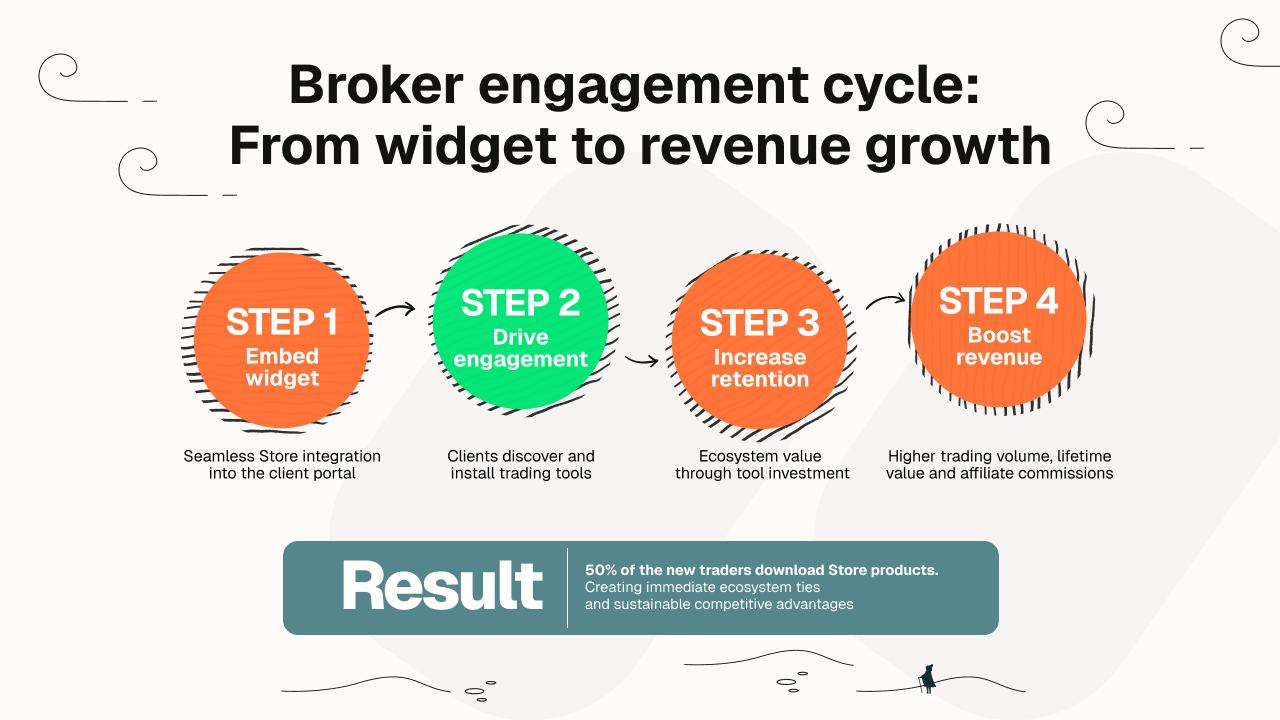

Recent data from Spotware's COO reveals that almost 50% of new cTrader users download Store products, signalling unprecedented adoption rates that smart brokers are already capitalising on. The question isn't whether traders will use algorithmic trading tools. The question is whether you'll profit from that usage (or watch competitors capture the opportunity).

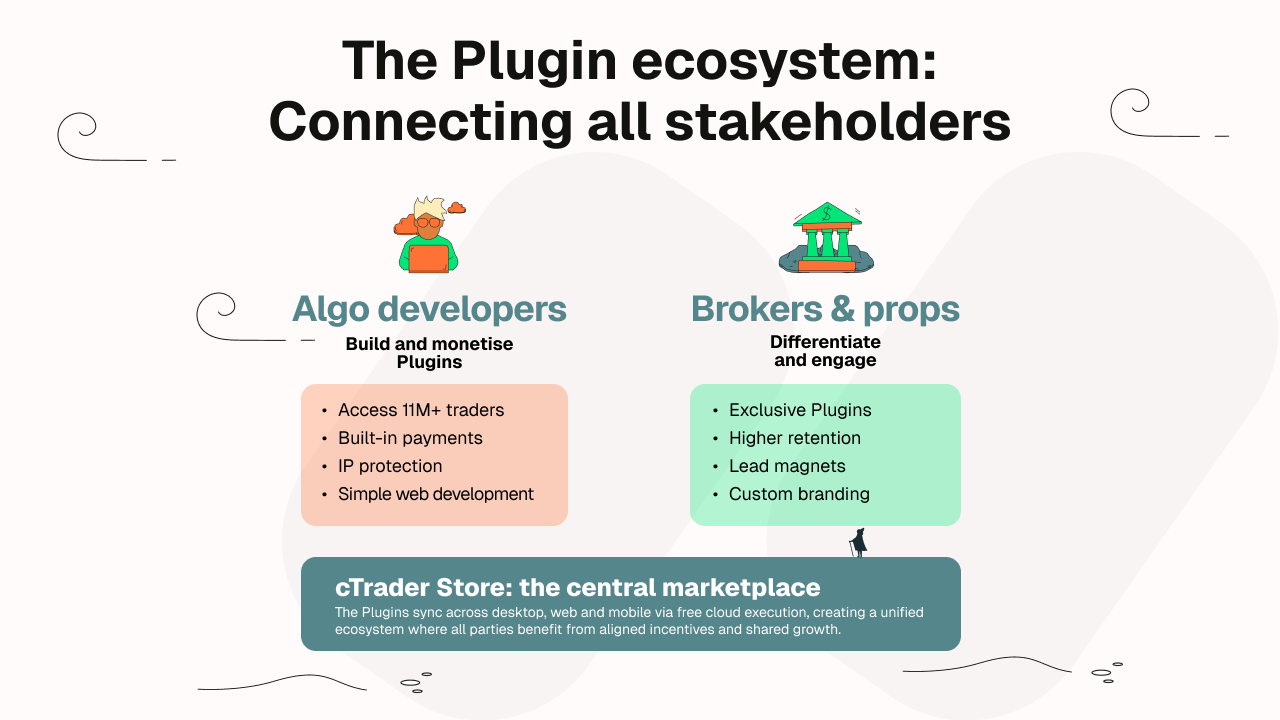

Here we break down how cTrader Store creates tangible business value across three critical stakeholder groups: brokers and prop firms seeking higher trader engagement and trading volume, and algo developers building monetisable trading tools.

Marketplace overview: Diverse, trusted and ready-made

cTrader Store solves the core distribution problem that has plagued algorithmic trading for decades. Previously, algo creators faced fragmented distribution channels, suspicious payment methods and zero intellectual property protection. Traders encountered dubious marketplaces with unverified products and security risks. Brokers watched their clients purchase tools elsewhere, generating zero ancillary revenue.

The platform eliminates these friction points through four structural advantages:

- Diverse offerings across all trader segments. The marketplace hosts trading bots (i.e., cBots), indicators, copy strategies and the new Plugin category, spanning free community tools to premium commercial products, with copy strategies to follow. Novice traders access indicators whilst institutional clients deploy sophisticated algorithmic strategies. This breadth keeps traders within your ecosystem regardless of their skill progression.

- Professional monetisation infrastructure. Spotware has partnered with a trusted payment provider, with all products safeguarded through built-in licensing and copy protection. The source code of products is never available to end users, protecting intellectual property. This professional infrastructure legitimises the entire ecosystem and attracts serious tech partners who create premium tools that differentiate your broker offering.

- Free cloud execution without VPS. The cTrader ecosystem now includes free algo hosting and cloud execution for cBots, enabling device-independent, 24/7 algo trading. This dramatically lowers the technical barrier for algorithmic trading adoption, expanding your addressable market.

- Trusted marketplace dynamics. Sellers complete a quick and straightforward verification process, with all transactions 100% secure and all parties protected from digital scams. The reputation system, combined with Spotware's oversight, creates marketplace trust that independent algo developers cannot replicate. Traders receive verified, working products rather than gambling on unknown sources.

The strategic insight: cTrader Store doesn't just provide tools. It creates a legitimate, professional ecosystem that keeps traders engaged within your branded environment whilst generating new revenue streams and competitive differentiation.

For brokers and prop firms: Embed, engage and grow

The broker opportunity centres on the cTrader Store widget, an integration that embeds the entire marketplace directly into your trader portal or website. Traders stay within your branded environment whilst they discover and purchase trading tools.

Frictionless access drives higher engagement

The widget is available in iframe or JavaScript formats, allowing brokers to integrate custom web content directly into their platform. Traders browse algorithms, read reviews, purchase products and install tools without ever leaving your portal. This seamless experience eliminates the friction that typically causes traders to abandon purchases or seek tools elsewhere.

The engagement impact compounds over time. Traders who use algorithmic tools demonstrate significantly higher activity levels than manual traders. They monitor positions more frequently, maintain larger account balances to support automated strategies and trade across more instruments to diversify their algo portfolios. Each of these behaviours directly increases your revenue per trader.

Alongside the Store widget, the official cTrader Brokers page and cTrader Prop page act as external discovery engines for your business. Traders who already prefer cTrader use them to find brokers and prop firms to trade with, sending a steady stream of organic, high-intent traffic to listed firms. Because the listings are free, they effectively become extra lead sources running quietly in the background while your team focuses on higher-touch sales and marketing.

Affiliate Program unlocks revenue potential

The cTrader Affiliate Program represents a powerful monetisation opportunity for brokers and partners. By promoting cTrader Store products and the platform itself, affiliates earn commissions on sales and client referrals. This creates an additional revenue stream beyond traditional spreads and commissions, allowing brokers to profit from their clients' use of algorithmic trading tools.

The affiliate structure aligns incentives across the ecosystem. When you promote quality Store products to traders, you generate affiliate revenue whilst simultaneously improving client retention and trading activity. Your marketing efforts compound: better tools lead to more engaged traders, who generate more trading volume and purchase additional products, creating a virtuous cycle of growth.

Custom integration maintains brand consistency

Plugins sync across all cTrader apps, ensuring clients experience consistency whether they access your portal via desktop, web or mobile. Your branding remains front and centre whilst cTrader Store handles the complex backend operations of payment processing, product delivery and licence management.

Smart brokers customise the widget placement strategically. Some position it prominently on dashboard landing pages to drive discovery. Others integrate it within their trading platforms as contextual recommendations. The flexibility allows you to test different placements and optimise for your specific trader behaviour patterns.

Higher retention within the ecosystem

Clients who invest in cTrader Store products create psychological and financial barriers to switching. After purchasing multiple indicators or spending time configuring their favourite cBots, moving to another platform means abandoning those investments. This natural stickiness increases client lifetime value and reduces churn rates.

The data supports this intuition. Almost 50% of new traders download cTrader Store products, meaning 50% of traders immediately develop ecosystem ties beyond just holding account balances. These aren't casual users but committed clients building their trading infrastructure around your platform.

Consider the compounding effects. A trader who purchases a $50 indicator isn't just generating one-time revenue. They're more likely to: maintain higher account balances, trade more actively to justify their tool investment, explore additional products from the Store and recommend your broker to other traders seeking algo-friendly platforms. Each interaction strengthens their connection to your ecosystem.

For algo developers: Expand through collaboration

The algo developer opportunity extends beyond simply selling products. The Developer Motivation Program represents an invite-only initiative where algo developers test new features, influence Store direction and access partner programmes.

Plugins unlock new integration possibilities

Next-generation Plugins run on any cTrader platform: Windows, Mac, Web and Mobile. Launch them instantly and trade directly from the interface. These Plugins empower brokers and traders to embed custom web content, from AI assistants and market insights to trading tools, directly within the cTrader platform. Creating a plugin is simple: just build a web service that connects to the cTrader backend via the dedicated API, with no advanced coding required.

The strategic implications are significant. Previously, reaching active traders required expensive customer acquisition or complex integration negotiations with individual brokers. Plugins now connect brokers, algo developers and introducing brokers in a shared marketplace where cBots, indicators and copy strategies can be bought, sold or distributed freely.

Consider practical applications. A broker or a prop firm can build a Plugin that embeds their service directly within cTrader's interface. Whether it's AI-powered assistants, real-time dashboards or custom newsfeeds, these Plugins make it easy to enrich the user experience with a wide range of web-based tools. Users access your service without leaving their trading platform, dramatically improving adoption and reducing friction.

Developer Motivation Program creates early-mover advantages

The Developer Motivation Program provides early access to new tools and platform updates. For brokers and prop firms, this means access to cutting-edge tools and exclusive Plugins that can differentiate your platform from competitors.

Spotware CEO Ilia Iarovitcyn stated, "Plugins give the cTrader community something they've never had before: true cross-platform flexibility with minimal development friction". This technical accessibility expands the pool of qualified tech partners whilst maintaining quality standards that protect broker reputations.

B2B collaboration amplifies reach

By developing and publishing exclusive Plugins in cTrader Store, brokers can turn these tools into high-impact lead magnets that boost engagement and attract new traders. This creates partnership opportunities where algo developers build custom tools for specific brokers, receiving both development fees and ongoing revenue sharing as those brokers promote the tools to their client bases.

Consider the strategic positioning. An algo developer with a proven product in cTrader Store approaches brokers with a compelling proposition: "I'll build a branded version of my successful tool exclusively for your traders." The broker gains differentiation, the algo developer gains guaranteed distribution and revenue, and traders receive premium tools unavailable elsewhere. All parties benefit from aligned incentives.

The collaborative model scales efficiently. One well-crafted tool can generate multiple broker partnerships, each promoting the tool to their client base. Your development effort gets leveraged across multiple distribution channels whilst brokers compete to offer your tools exclusively or with preferential terms.

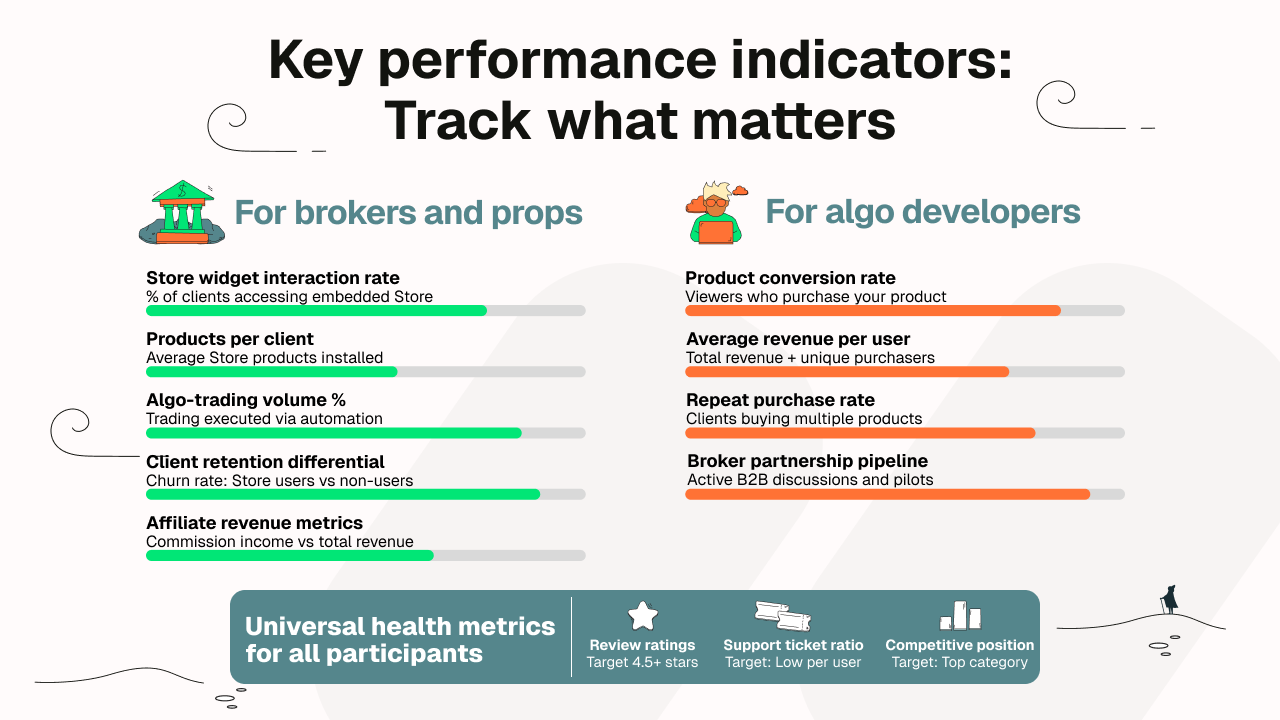

Measuring success: Key performance indicators for each stakeholder

Success metrics differ across stakeholder groups, but certain indicators reliably predict sustainable growth within the cTrader Store ecosystem.

For brokers and prop firms, track these engagement metrics:

- Store widget interaction rate: Percentage of clients who access the embedded Store versus total active clients. High interaction rates signal successful positioning and client awareness.

- Products per client: Average number of Store products installed per active trader. This metric directly correlates with retention and trading volume.

- Algo-trading volume percentage: Proportion of total trading volume executed through automated strategies. Higher percentages indicate deeper ecosystem integration.

- Client retention differential: Compare churn rates between clients who use Store products versus those who don't. The difference quantifies the retention value of Store integration.

- Affiliate revenue metrics: Track commissions generated through the affiliate program relative to overall revenue. Growing affiliate income indicates successful ecosystem monetisation.

For algo developers, monitor these revenue and growth signals:

- Product conversion rate: Percentage of profile visitors who purchase your product. This indicates product-market fit and effective positioning.

- Average revenue per user: Calculate total revenue divided by unique purchasers. Higher ARPU suggests your product solves valuable problems worth premium pricing.

- Repeat purchase rate: Percentage of clients who buy multiple products or upgrade to premium versions. This measures genuine satisfaction beyond initial curiosity.

- Broker partnership pipeline: Number of broker discussions, pilot programmes and partnership agreements in progress. B2B relationships multiply your distribution.

Universal health metrics apply across all participants:

- Review ratings and volume: Maintain above 4.5 stars with growing review counts. Lower ratings signal quality issues requiring immediate attention.

- Support ticket ratio: Track support requests per transaction or active user. Low ratios indicate intuitive products; high ratios suggest user experience problems.

- Competitive positioning: Monitor your category rankings and how competitors evolve their offerings. Sustainable success requires continuous improvement against rising standards.

Set baseline metrics when launching Store initiatives, then establish quarterly improvement targets. The marketplace rewards consistent iteration over dramatic but unsustainable launches.

Common implementation mistakes and how to avoid them

Despite cTrader Store's structural advantages, certain predictable mistakes undermine success. Learn from early participants rather than repeating their errors.

- Mistake one: Treating quality standards as negotiable. The Store maintains enterprise-level expectations for all products. Professional documentation, robust support infrastructure and reliable performance are non-negotiable. For brokers evaluating tech partners, prioritise vendors with proven track records.

- Mistake two: Neglecting broker relationships. Tech partners who proactively engage brokers with partnership proposals create mutual value. For brokers, reaching out to successful Store vendors opens doors to exclusive differentiation opportunities.

- Mistake three: Poor Store widget integration. Brokers who bury the Store widget in obscure menu sections generate minimal engagement. Test different positions, add contextual recommendations and actively promote Store access to traders.

- Mistake four: Misunderstanding pricing psychology. Free products build audiences but generate zero revenue. Premium pricing without clear value propositions generates zero sales. The sweet spot: Offer a genuinely useful free version that demonstrates capability, then charge meaningfully for premium features that deliver clear additional value.

- Mistake five: Ignoring affiliate opportunities. Brokers who fail to leverage the affiliate program leave revenue on the table. Integrate affiliate links strategically and promote quality products that genuinely benefit traders.

Future-proofing your Store strategy

cTrader Store is rapidly evolving, and 2025 will be a milestone year with some major updates ahead. Strategic participants position themselves to benefit from upcoming developments rather than reacting after changes launch.

Platform features continue to expand capabilities. cTrader 5.5 introduces native Python support for algorithmic trading. For brokers, new capabilities mean your platform offering evolves without requiring internal development resources.

Platform features continue to expand algo developer capabilities. cTrader 5.5 introduces native Python support for algorithmic trading, giving developers direct access to powerful automation without limitations. Developers who master new capabilities early can build products competitors cannot replicate quickly, creating temporary monopolies on valuable features.

For brokers and props, the strategic imperative centres on integration depth. Basic Store widget integration provides baseline benefits. Advanced integration (contextual recommendations, broker-exclusive tools, integrated education content) creates genuine competitive differentiation. As more brokers adopt Store widgets, deeper integration separates leaders from followers.

The fundamental principle: cTrader Store rewards participants who treat it as a strategic platform rather than a tactical channel. Build for sustainable long-term positioning rather than extracting short-term gains.

Conclusion: Extending ecosystem potential beyond terminals

cTrader Store fundamentally shifts how brokers and props approach the trading ecosystem. The traditional model (brokers provide execution while traders source their own tools) created friction, mistrust and missed opportunities across all parties.

The integrated marketplace model aligns incentives. Brokers gain engagement, retention and ancillary revenue through both direct client activity and affiliate commissions. Algo developers can build monetisable cBots.

The business case transcends simple revenue calculations. A broker integrating cTrader Store isn't just adding another feature, but rather building an ecosystem 'stickiness' that compounds over months and years.

The expanded cTrader Store connects brokers and introducing brokers in a shared marketplace where trading tools can be bought, sold or distributed freely. This network effect creates value beyond individual transactions. Each participant strengthens the ecosystem, attracting more participants, which generates more value, continuing the cycle.

Smart operators recognise this isn't optional positioning. It's a strategic necessity. Traders will use algorithmic trading tools. The question is whether you'll profit from that usage, deepen client relationships and build competitive differentiation (or watch competitors capture those opportunities whilst you provide basic execution services).

The path forward requires action rather than observation. Brokers: Integrate the Store widget strategically, join the affiliate program and measure engagement metrics, while algo developers explore Plugin opportunities and join the Developer Motivation Program. Each stakeholder group benefits from early participation whilst the ecosystem still offers first-mover advantages.

cTrader Store extends your business potential beyond terminal provision. It's a growth engine for brokers seeking retention, a distribution platform for algo developers monetising expertise and a gateway for brokers and prop firms reaching active traders. The foundation exists. The infrastructure works. The ecosystem grows. The opportunity is clear. Talk to our Sales team to see just how much the Store can do for you.