The proprietary trading industry has exploded in recent years, with search demand for "prop firm" skyrocketing by 8,409% between early 2020 through mid-2024. As the sector evolves and matures, successful prop firms are discovering that growth hinges not just on recruiting traders, but also on deploying sophisticated prop trading CRM systems and technology infrastructure powered by platforms like cTrader that can manage thousands of participants simultaneously.

Unlike traditional retail brokerage operations, prop trading firms require specialised Customer Relationship Management (CRM) systems that go far beyond basic client databases. Such prop trading software platforms serve as comprehensive business management hubs, orchestrating everything from trader evaluations and risk management to automated payouts and compliance monitoring.

It’s no overstatement to say that as an entrepreneur launching a prop firm or as an existing operator looking to scale, selecting the right prop trading CRM represents one of the most critical technology decisions you'll make.

Modern prop firms manage fairly complex workflows involving evaluation phases, drawdown rules, profit splits, and scaling criteria. The firms that thrive are those that leverage prop trading CRM technology to automate these processes, reduce operational overhead, and provide transparent, real-time insights to both administrators and traders.

Why Prop Firms Need Specialised Prop Trading CRM Systems

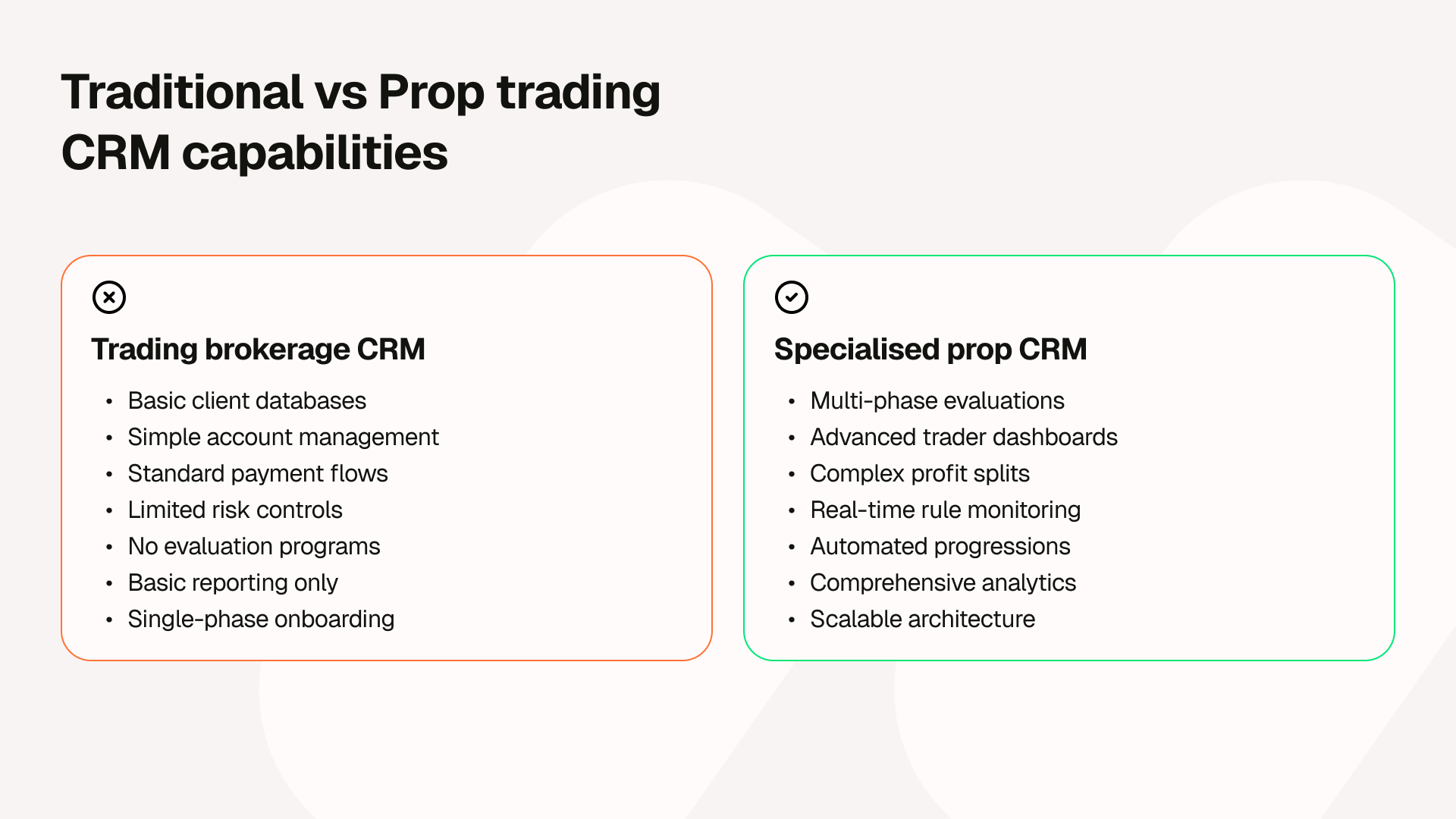

Traditional forex or CFD brokerage CRMs fall short when applied to proprietary trading operations. Prop firms operate under fundamentally different business models that demand purpose-built prop firm management system functionality.

- Evaluation Program Management. The cornerstone of most prop firms is their trader evaluation platform process. Participants purchase challenges with specific trading rules, profit targets, and maximum drawdown limits. A specialised prop trading CRM automates the entire evaluation life cycle—from initial purchase through phase progressions to final funding decisions. This includes real-time monitoring of trading metrics, automatic rule violations detection, and seamless progression between evaluation phases.

- Trader Dashboard Integration. Unlike retail clients (who primarily need basic account information), prop traders require comprehensive performance analytics through advanced prop trading software. They need to monitor their progress against evaluation criteria, track profit splits, view payout schedules, and understand exactly where they stand in multi-phase programs. Advanced prop trading CRM systems provide intuitive trader portals that eliminate support queries by giving participants complete visibility into their accounts.

- Payment processing Complexity. Prop firms handle unique payment flows that traditional brokerage CRMs simply aren't designed for. They collect evaluation fees upfront, process profit distributions based on complex splitting arrangements, and manage partial refunds for successful completions of challenges. The prop firm management system must integrate with multiple payment gateways, handle multiple currencies, and provide fraud detection capabilities.

- Risk Management Integration. Prop firms face different risk profiles than traditional brokers. Rather than managing market-making risk, they need to monitor individual trader behavior, detect rule violations in real-time, and automatically enforce account restrictions. The prop trading CRM must thus integrate closely with trading platforms to provide instant risk controls and monitoring capabilities.

- Scalability Requirements. Successful prop firms often manage thousands of traders simultaneously across multiple programs. The prop trading software infrastructure must handle this scale without performance degradation, while also maintaining data integrity and providing real-time reporting capabilities.

Compliance and transparency. Modern prop trading operates virtually without any regulatory oversight, due to the fundamentally different funding structure (prop firms aren’t handling client funds, but their own). While the need for comprehensive audit trails and automated compliance monitoring is thus vastly reduced or absent, a prop CRM’s abilities in transparent reporting and compliant data handling are still crucial (tracking all trader interactions and maintaining secure, detailed transaction records).

Leading Prop Trading CRM Software Providers: A Comprehensive Analysis

Skale CRM: The Integration Powerhouse for Prop Trading

SkaleCRM positions itself as "The #1 Forex & Prop CRM - Built for Brokers" with a strong emphasis on trusted, integrated, and compliant prop trading software solutions. The platform has indeed built a reputation for its extensive integration capabilities and modular architecture.

Core Strengths: Skale's standout feature is its deep integration with trading platforms. The prop trading CRM offers Single Sign-On (SSO) functionality with cTrader, allowing traders to register, deposit, and withdraw directly from the app without separate logins. This seamless experience significantly improves conversion rates and trader retention.

The platform's modular approach allows prop firms to activate only the features they need while maintaining the ability to scale. Advanced reporting and analytics capabilities provide comprehensive business intelligence, while automation tools reduce manual administrative overhead - a key benefit.

- Ideal client profile: Skale CRM suits established prop firms and brokers who prioritise platform integrations and require sophisticated automation. Its comprehensive feature set makes it particularly valuable for operators managing complex multi-phase evaluation programs.

- Potential limitations: The extensive feature set may create complexity for smaller operators or startups who need simpler, more streamlined prop trading software solutions (the learning curve with Skale CRM can be steeper compared to more basic alternatives).

FXBO CRM: The Comprehensive Prop Trading Solution

FXBO has already established itself as a major player in the forex and CFD space, with recent expansion into specialised prop trading CRM functionality. FXBO's Prop Trading CRM promises to "streamline challenges, automate trader management, and track real-time performance with ease."

Core Strengths: The new prop trading system features admin and client portals, integrations with various payment methods and email services, 24/7 support, and guaranteed fast fund withdrawals. The platform emphasises user-friendly interfaces and straightforward reporting, making it accessible for operators with varying technical expertise.

FXBO also seamlessly integrates with leading trading platforms like cTrader, resulting in a smooth data flow and synchronisation that minimises operational hassles. The prop trading software platform's strength lies in its balance between functionality and usability.

- Ideal client profile: FXBO appeals to mid-sized prop firms that need comprehensive prop trading CRM functionality without excessive complexity. Its emphasis on user-friendly interfaces makes it particularly suitable for operators who prioritise ease of use over advanced customisation.

- Potential limitations: While comprehensive, FXBO may lack some of the advanced customisation options that larger, more sophisticated operations require. The platform's focus on simplicity might limit flexibility for some more unique business models.

Kenmore Design: A unified CRM and operational platforms for prop firms

Kenmore Design has established itself as a leading provider of end-to-end CRM and operational solutions for brokerages and proprietary trading firms. Built to simplify and automate trading operations, it helps firms manage onboarding, compliance and performance tracking within a single ecosystem. Its adaptable design and integration capabilities make it a dependable choice for companies focused on efficiency, transparency and growth.

Core strengths: Kenmore Design’s standout feature is its ability to link trading activity with back-office management through real-time data synchronisation. Its integration within the cTrader ecosystem allows trading data - such as orders, balances, and performance metrics—to update instantly within the CRM and dashboard, giving firms accurate visibility over trader activity and system performance.

The platform also offers extensive customisation, enabling firms to set challenge rules, payout structures and compliance logic to suit their business model. Built-in tools for payments, risk monitoring, and reporting strengthen operational control, while its APIs and data-push mechanisms ensure platform data, including from cTrader, can be leveraged for analytics and automation.

Ideal client profile: Kenmore Design is best suited to mid-sized and large proprietary trading firms or brokerages looking for a comprehensive solution to manage onboarding, challenges, payouts and risk processes within one system. It is particularly valuable for firms seeking to streamline operations, enhance data visibility and scale efficiently.

Potential limitations: Due to its broad feature set and high configurability, Kenmore Design may be complex to implement for smaller firms or those without technical teams. In simpler business models, some of its advanced functions may go underused, making a lighter CRM a more practical choice.

TechySquad: A tailored and scalable CRM platform for prop firms

TechySquad has established itself with over 10 years of innovation in Customer Relationship Management (CRM) systems, offering a tailored prop trading CRM solution for proprietary trading firms to manage operations seamlessly. From onboarding funded traders to monitoring trading accounts and performance, TechySquad's platform ensures genuinely comprehensive operational control.

Core Strengths: TechySquad's standout feature is its multi-platform support, being compatible with cTrader and other platforms, along with seamless integration with cTrader, ensuring a cohesive and efficient workflow for brokers. This integration allows for real-time data synchronisation, providing brokers with up-to-date information on their clients' activities and preferences.

The platform offers customisable solutions that are tailor-made to meet brokers' specific needs and preferences, including multi-level IB commission tools and highly customisable client interaction management. TechySquad was recently named Best CRM Software Provider in the Middle East and Africa, demonstrating its legitimate market recognition and reliability.

Ideal client profile: TechySquad suits mid-sized to large prop firms that need comprehensive functionality with strong platform integration capabilities. Its proven track record makes it particularly valuable for operators who require reliable, battle-tested prop trading software solutions.

Potential limitations: While comprehensive, TechySquad's extensive feature set may create complexity for smaller startups that need more streamlined solutions. The platform's focus on multi-platform support might include features unnecessary for firms committed to a single trading platform.

Key Selection Criteria for Prop Trading CRM Systems in 2025

Scalability Architecture

The most critical factor for any growing prop firm is the prop trading CRM's ability to handle scale. Can the system manage 5,000+ active traders without performance degradation? Does it support horizontal scaling as trader volumes increase? Look for prop trading software solutions that demonstrate proven scalability in production environments, not just theoretical capabilities.

Database architecture matters significantly. Here, systems built on modern, distributed databases typically handle growth better than legacy platforms. Consider the provider's track record with large-scale implementations and their technical support capabilities during growth phases.

Trading Platform Integrations

Platform integration quality can make or break operational efficiency. The prop trading CRM should connect seamlessly with your chosen trading platform, providing real-time data synchronisation, automatic risk monitoring, and unified user experiences.

cTrader integration deserves special attention due to the platform's modern architecture and growing popularity among prop firms. cTrader's free cloud execution for trading robots (cBots) with no VPS required, stable pricing (no unexpected price hikes) and advanced analytics capabilities make it an excellent foundation for prop trading operations. When combined with a well-integrated prop trading CRM, it creates a powerful technology stack that supports each of the prop trading software platforms discussed — Skale, FXBO, TechySquad, and FPFX — offers distinct advantages for different types of operations. Skale excels in integration capabilities, FXBO balances functionality with usability, TechySquad provides comprehensive multi-platform support with proven market recognition, and FPFX delivers prop trading specialisation.and operational efficiency.

Look for integrations that support Single Sign-On (SSO), real-time data feeds, automated risk controls, and seamless account management (the quality of these integrations often determines user adoption rates and your ultimate operational overhead).

Payment Processing Capabilities

Prop firms handle complex payment flows that require sophisticated processing capabilities. The prop trading software should easily and seamlessly support multiple payment methods, currencies, and geographic regions. Consider automated payout capabilities, fraud detection, and integration with major payment gateways.

Speed matters significantly in payment processing. Traders expect fast payouts, and delays can damage reputation and retention rates. Evaluate the provider's payment processing track record and their ability to handle your projected transaction volumes.

Evaluation Program Customisation

Different prop firms use various evaluation models, from simple one-phase challenges to complex multi-stage programs. The trader evaluation platform should thus provide complete flexibility in configuring evaluation rules, profit targets, drawdown limits, scaling criteria, and progression logic.

Look for prop trading CRM systems that can handle dynamic rule changes, A/B testing of different evaluation models, and automated enforcement of all program parameters. The ability to quickly launch new evaluation products can provide significant competitive advantages.

Brand consistency and customisation

Your CRM is the primary touchpoint between your traders and your firm. Look for systems that allow you to reflect your own brand identity across portals, dashboards and communications. This ensures a professional trader experience without requiring complex multi-label setups.

Here, consider the depth of branding customisation available and the technical requirements for implementation (some platforms offer extensive customisation options but require significant development resources to implement).

The cTrader Advantage in Prop Trading Technology

The leading prop trading CRM providers integrate with cTrader because the platform addresses several critical needs for proprietary trading operations. Specifically, cTrader's modern, cloud-native architecture provides the reliability and performance that prop firms require for managing large trader populations.

cTrader embodies transparency with no hidden manipulation or unfair execution, as the platform provides Trade Receipts with all necessary information about each trade that can be used to hold brokers accountable. Traders can see, amongst others, chronological events, slippage, an L2 market snapshot, and execution time. In a nutshell, cTrader Admin (cTrader's powerful back office) offers flexible symbol, order and position management and advanced risk management features that provide comprehensive oversight of trader activities.

For prop firms, the combination of a robust prop trading CRM and cTrader creates a technology foundation that supports sustainable growth, minimises admin, and optimises profit potential. The platform's modern infrastructure handles scale efficiently, while its integration capabilities ensure smooth data flow between systems. More than just jargon, these issues go straight to your bottom line as a prop firm founder.

When evaluating prop trading software options, consider how well each integrates with cTrader and whether that integration supports your specific operational requirements. The quality of this integration often determines the overall user experience for both administrators and traders.

Implementation and Success Factors for Prop Trading CRM Systems

Planning Your Prop Trading CRM Selection

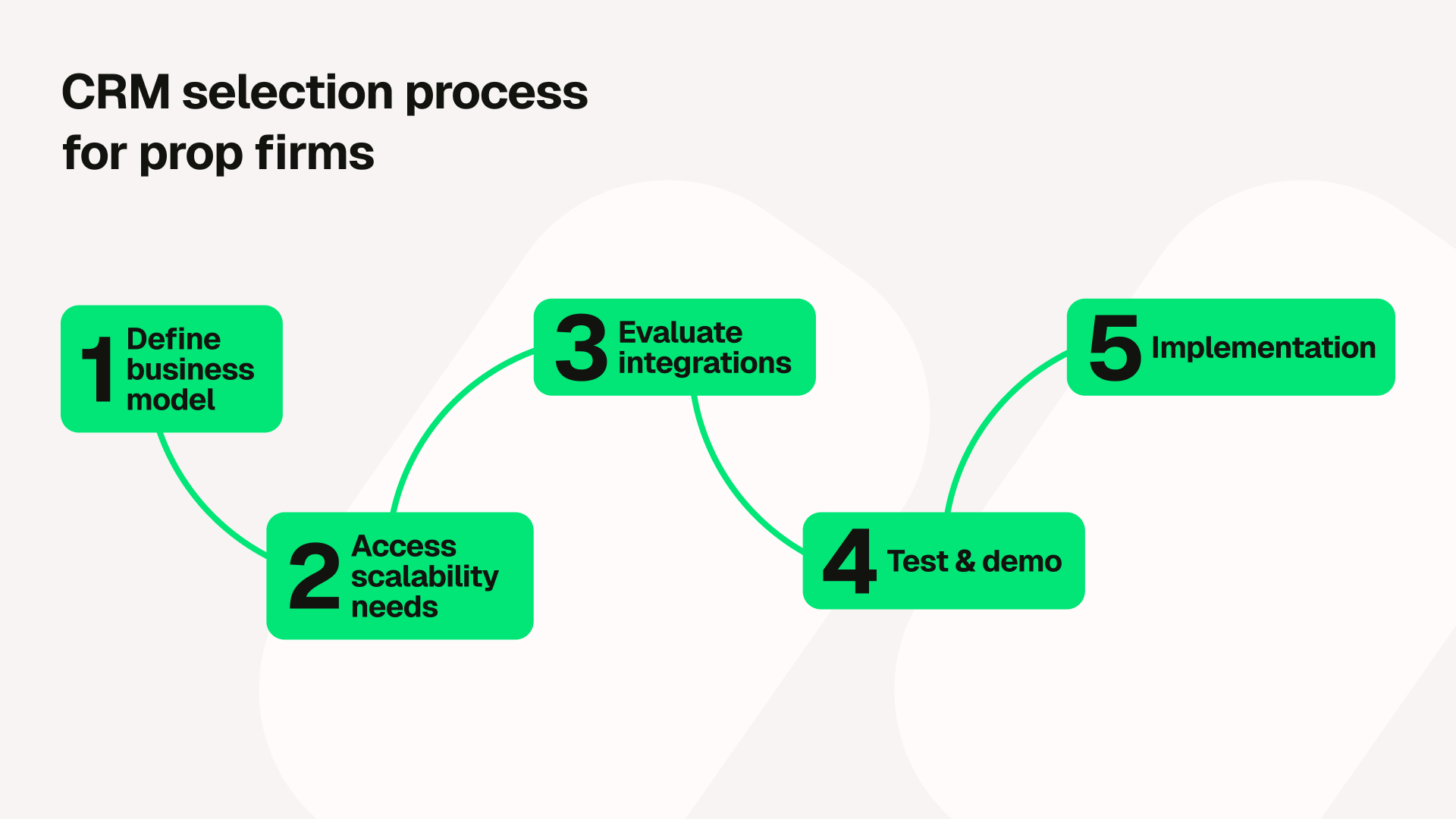

Start by clearly defining your business model and growth projections. Different prop trading approaches — whether focused on forex, futures, equities, or multi-asset trading — may require different prop trading software capabilities. Consider your target trader demographics, evaluation program complexity, and geographic expansion plans.

Create a detailed requirements document that covers current needs and projected growth over 2-3 years. This forward-looking approach prevents costly migrations as your business scales. Include specific integration requirements, possible compliance needs, and performance expectations.

Evaluation Process

Request comprehensive demonstrations from shortlisted prop trading CRM providers, focusing on real-world scenarios rather than just generic presentations. Test the systems with your actual evaluation rules, payment flows, and trader volumes where possible. This kind of initial sampling pays big dividends in keeping project costs down.

Migration and Integration

Plan for a thorough data migration if you're switching from an existing system. This includes trader accounts, historical performance data, and payment records. Establish clear timelines and contingency plans for potential migration challenges.

Integration testing is crucial, particularly for trading platform connections and payment processing. Conduct extensive testing in non-production environments before going live. Also, you want to consider phased rollouts that minimise disruption to ongoing operations.

Future-Proofing Your Prop Trading Technology Stack

The proprietary trading industry continues evolving rapidly, driven by technological advances and changing trader expectations. Your prop trading CRM selection should account for these trends and provide flexibility for adaptation.

Although it’s hard to predict the future, the forces shaping the evolution of prop trading operate within known boundaries, and the flexibility you require of your chosen CRM should be aware of likely shifts and ready to embrace them - a fair ask.

- Technology integration: APIs and integration capabilities will become increasingly important as the fintech ecosystem continues expanding. Select prop trading CRM systems with robust API frameworks that support future integrations with emerging technologies.

- Mobile-first experience: Trader expectations for mobile functionality continue rising. Ensure your chosen prop trading software provides comprehensive mobile capabilities and speaks the language of mobile technology trends.

- Data analytics: Advanced analytics and machine learning capabilities are becoming competitive advantages. Consider platforms that provide sophisticated reporting capabilities and support for advanced analytics tools.

- Regulatory evolution: Prop trading faces almost zero regulatory scrutiny globally, but by choosing prop trading software systems with strong compliance capabilities and providers who actively monitor regulatory developments, your prop trading sector will be ready for any future regulatory overtures, and also allow you to sample traditional trading platform capabilities if you imagine that to be a component of your future expansion.

Conclusion

Selecting the right prop trading CRM system represents a foundational decision that will impact every aspect of your proprietary trading operation. The companies that succeed in this competitive landscape are those that leverage prop trading technology to create seamless, scalable, and transparent experiences for their traders, while maintaining operational efficiency.

Each of the prop trading software platforms discussed — Skale, FXBO and TechySquad — offers distinct advantages for different types of operations. Skale excels in integration capabilities, FXBO balances functionality with usability, and TechySquad provides comprehensive multi-platform support with proven market recognition.

The key is evaluating these prop trading CRM options against your specific requirements, growth projections, and operational philosophy. Consider not just current needs but your long-term vision for the business. As with many other enterprise types, the most successful prop firms are those that build their technology foundation to support sustainable growth rather than just immediate requirements.

When combined with modern trading infrastructure like cTrader, a well-chosen prop trading CRM creates a powerful technology foundation that enables you to scale efficiently, while maintaining the transparency and performance that your traders will demand.

If you're exploring prop trading software and platform solutions for a proprietary trading firm, the integration between your chosen prop trading CRM and trading platform will largely determine your operational efficiency and trader satisfaction.

Reach out to learn how cTrader integrates with leading CRMs to create comprehensive solutions for the modern prop trading industry.

FAQ

What's the typical implementation timeline for a prop trading CRM system?

Implementation timelines for prop trading software vary significantly based on complexity and customisation requirements. Simple deployments can be completed in 4-6 weeks, while comprehensive enterprise implementations may take 3-6 months. The key factors affecting the timeline include data migration complexity, integration requirements, custom feature development, and testing thoroughness. Most prop trading CRM providers offer phased implementation approaches that allow you to begin operations quickly while adding advanced features over time.

Can these prop trading CRM systems integrate with custom trading platforms or proprietary systems?

Most enterprise-grade prop trading software solutions offer API frameworks and custom integration capabilities for proprietary platforms. The complexity and cost of these integrations vary significantly based on the technical requirements and data flows involved. TechySquad and Skale CRM typically offer the most comprehensive integration capabilities, while FXBO provides standard integration options that balance functionality with ease of implementation. Evaluate integration requirements early on in the selection process to avoid costly surprises.

What are the typical cost structures for prop trading CRM software?

Prop trading CRM providers use various pricing models, including monthly subscriptions per trader, a percentage of revenue sharing, setup fees plus monthly charges, and enterprise licensing agreements. Costs typically range from $10 to 50 per trader per month for basic functionality, with enterprise solutions potentially costing significantly more. Many providers also offer volume discounts and custom pricing for large-scale operations. Consider the total cost of ownership (including implementation, training, and ongoing support) when comparing prop trading software options.

How do these trader evaluation platforms handle data privacy and security?

Reputable prop trading CRM providers implement comprehensive security frameworks, including data encryption, secure hosting infrastructure, regular security audits, and compliance with privacy regulations like GDPR. Look for providers with SOC 2 compliance, ISO certifications, and transparent security policies. The systems should provide detailed access controls, audit logging, and data backup capabilities. However, you should also implement your own security policies and procedures, beyond relying solely on the prop trading software provider's security measures.

Which prop trading CRM offers the best cTrader integration in 2025?

TechySquad offers seamless cTrader integration with real-time data synchronisation, while Skale CRM provides the most advanced cTrader integration with Single Sign-On (SSO) functionality. The best choice depends on your specific integration needs and whether you require advanced features like SSO or prefer a more comprehensive multi-platform approach.

What's the difference between prop trading software and traditional brokerage CRMs?

Prop trading CRM systems are purpose-built for the unique requirements of proprietary trading firms, including multi-phase evaluation programs, complex profit splits, trader dashboard analytics, and specialised risk management. Traditional brokerage CRMs focus on client onboarding, basic account management, and other standard trading services. Prop trading software must handle evaluation challenges, automated rule monitoring, performance tracking, and payout calculations that don't exist in traditional brokerage operations.

How quickly can a new prop firm get operational with these prop trading CRM systems?

Deployment speed varies by provider and complexity. TechySquad typically requires 4-10 weeks for full implementation, FXBO provides a balanced approach (4-8 weeks), while Skale CRM usually requires 6-12 weeks for full implementation due to its comprehensive feature set. However, most providers offer phased rollouts, allowing you to start basic operations quickly, while implementing advanced features progressively. However, most providers offer phased rollouts, allowing you to start basic operations quickly, while implementing advanced features progressively. Simple configurations can often go live within 2-4 weeks regardless of the chosen platform.