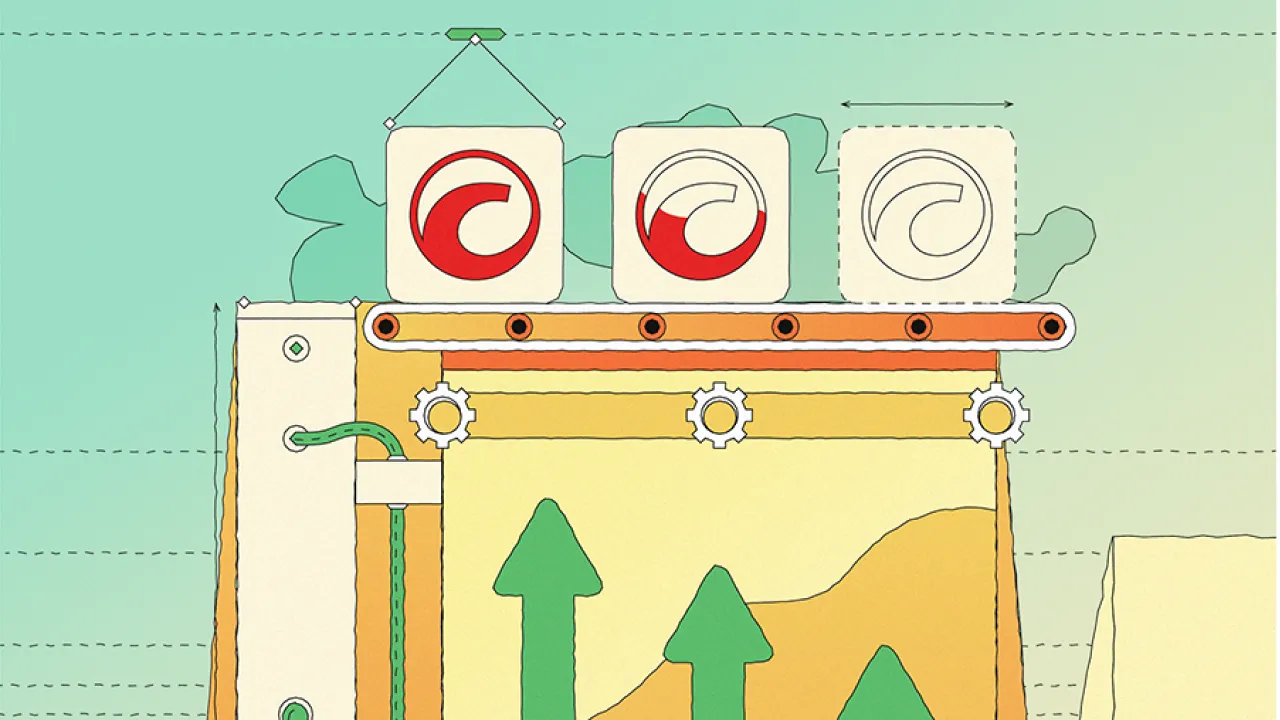

Spotware Systems announce that the company has revised the Stop Out algorithm used by their cTrader platforms. This new functionality is being branded as Smart Stop Out. This new Stop Out behaviour adds significantly more protection to traders in contrast to what is typically used by other popular platforms. When a trader's margin level falls below Stop Out level, positions will need to be adjusted to free up margin. The vital part is the method used to do this. cTrader now partially closes positions as opposed to closing them entirely. When Stop Out level is reached the platform will partially close positions in increments of 1,000 units in the case of Forex pairs or the lowest step according to the asset, until the margin used reduces enough for margin level to become higher than Smart Stop Out level. The logic doesn’t necessarily target losing positions either. The algorithm begins by partially closing the largest position since this uses the most margin. For spot metals, commodities, indices, equities and other CFDs the lowest possible increment for the instrument will be used as a basis for closing the position. “Our new Smart Stop Out algorithm is one of this year’s most exciting under-the-hood changes for every trader. The major differentiator from our previous Fair Stop Out algorithm is that positions are partially closed, this prevents traders from losing their entry points, which is very important in case of market prices change direction, allowing the trader to later close the position with a smaller loss or even in profit." - commented James Glyde, Head of Business Development at Spotware Systems. It was in December of 2014 when the company announced their Fair Stop Out algorithm which was also designed to work in the favor of traders, and to help protect their account. As part of the company's determination to inspire equality within the industry.

News

Articles

14 min read

Top 4 Trading Signal & Market Data Integrations Every Broker and Prop Firm Needs

Investors and traders today are spoilt for choice. Yes, they want attractive spreads and leverage, but today’s competition is also defined by credibility and user experience. Traders expect high-quali...

Articles

18 min read

CRM Systems for Prop Trading: The Ultimate Guide to Scaling Your Proprietary Trading Firm in 2025

The proprietary trading industry has exploded in recent years, with search demand for "prop firm" skyrocketing by 8,409% between early 2020 through mid-2024. As the sector evolves and matures, success...

Articles

14 min read

Do prop firms use real money? Understanding risk models and sustainable growth

Launching a proprietary trading firm is exciting, but the first decision is how much capital to risk. In practice, firms do not hand new participants large live accounts straight away. Candidates begi...