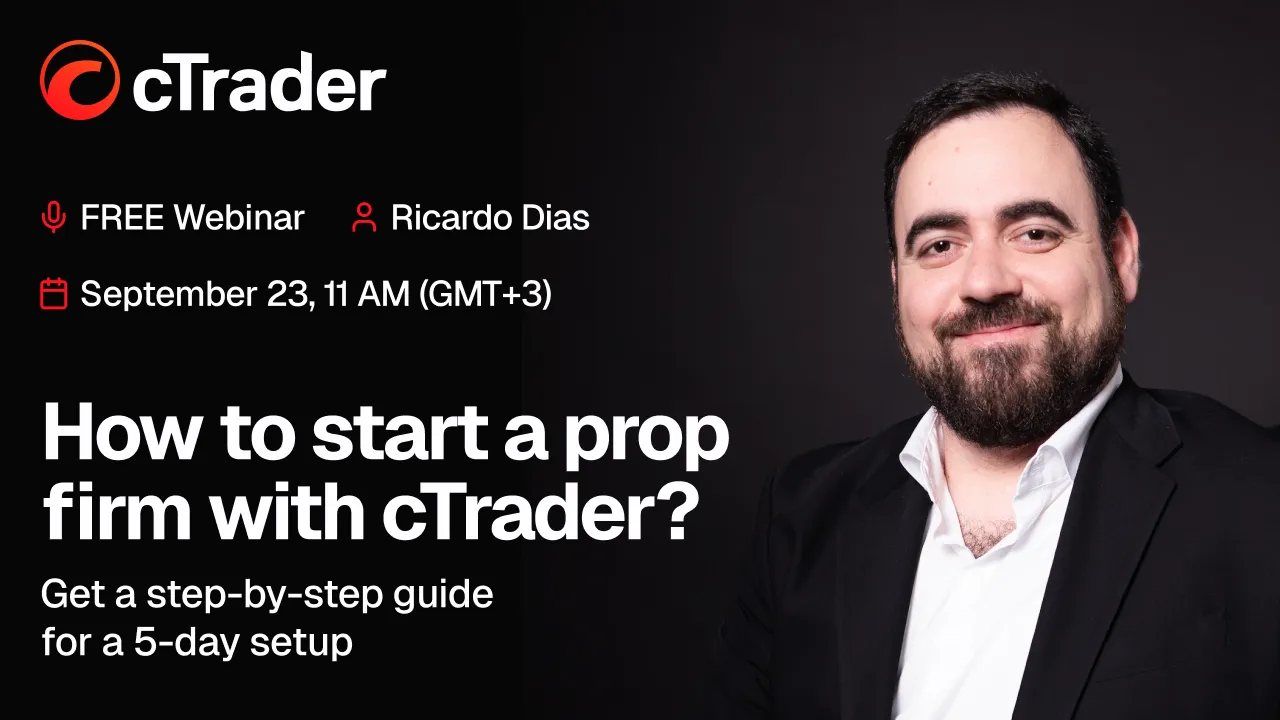

We’re pleased to announce the upcoming session, “How to start a prop firm with cTrader?”.

Date: Tuesday, 23rd September

Time: 11:00 AM (GMT+3)

Location: Zoom (online)

Registration: Free – register now

This webinar is designed to guide both aspiring entrepreneurs and established industry leaders through the steps of launching and scaling a prop trading firm with cTrader.

Covering everything from understanding the prop trading model and choosing the right technology infrastructure to growth strategies, risk considerations, and a 5-day cTrader setup, the event combines education with practical demonstrations.

For aspiring entrepreneurs, the webinar offers a clear path into prop trading — why now is the right time to start, how to structure costs and manage risk and how cTrader provides a fast track to market with trusted technology.

For experienced leaders, including prop firm founders and senior executives, the session highlights how cTrader can embed seamlessly into your existing operations to drive growth, boost trader engagement and retention and support long-term scalability.

Alongside expert insights, attendees will see a live demonstration of cTrader Admin, showcasing account administration, risk controls and behavioural analysis reports.

The event will conclude with a live Q&A session hosted by Business Development Manager Ricardo Dias, giving attendees the opportunity to engage directly with an expert and gain practical guidance tailored to their business needs.

“Attendees will walk away with a clear understanding of what it takes to launch a prop firm, the infrastructure required, and how cTrader helps firms enter this space with confidence,” said Mr. Dias.

About the Speaker

Ricardo Dias is a Business Development Manager with over 6 years in the financial technology sector. Currently, he specialises in the proprietary trading sector, guiding firms on how to leverage cTrader's automated risk management and tech solutions for rapid scaling. His experience working with a global portfolio of clients gives him a unique perspective on the operational challenges and opportunities in emerging and established markets.