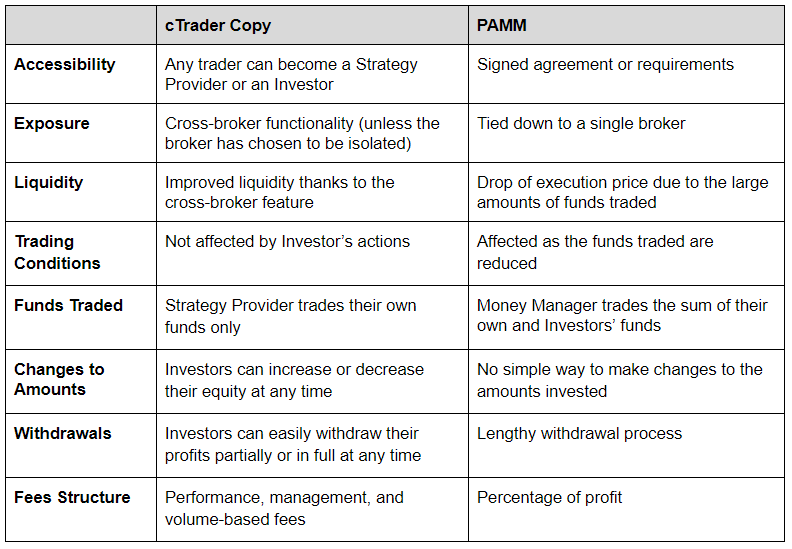

Due to the interest among PAMM users in cTrader Copy, a number of publications, such as Leaprate and ForexNewsNow, have recently published reviews comparing cTrader Copy to PAMM. Both models offer traders the possibility to invest their money and get potential profits while allowing Strategy Providers and Money Managers to receive extra earnings from providing their services. While this is the case, PAMM has also its limitations and risks. That is why more innovative programs, like cTrader Copy, have emerged offering the benefits of PAMM while enhancing it and providing additional benefits. cTrader Copy, an easy and transparent copy trading services of cTrader, provides more transparency, accessibility, flexibility, and control over funds comparing to PAMM, thus becoming a truly versatile investment platform that can serve the needs of any kind of Investor, Professional Trader or PAMM Manager. Many of you are already familiar with PAMM model. Let’s see how the cTrader Copy model works and then compare it to PAMM.

How cTrader Copy Works

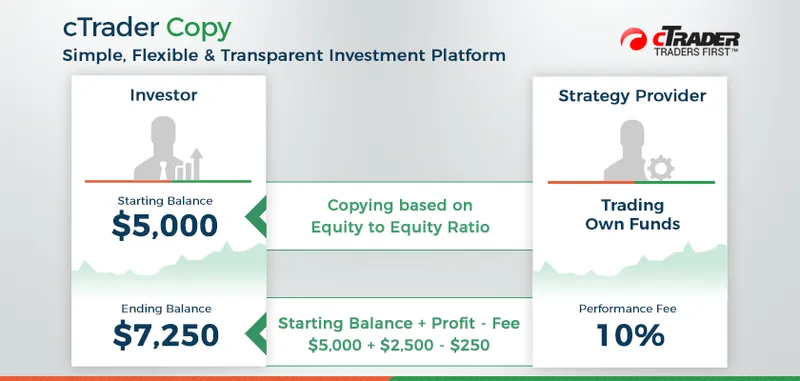

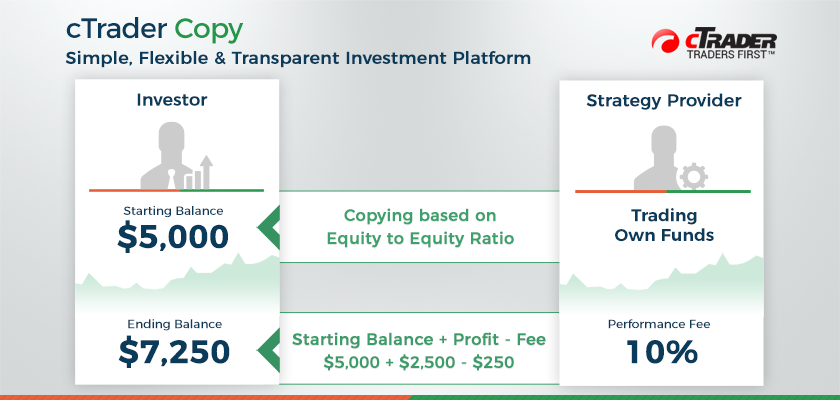

In cTrader Copy, traders can choose from a wide pool of strategies to invest in. The Strategy Provider trades their own funds and charges fees for allowing Investors to copy their strategy. All trades done by the Strategy Provider are copied by Investors based on equity to equity model. The equity to equity model means that the trades volume that will be copied is defined according to the ratio of Investor’s equity to Strategy Provider’s equity. Based on this, the Investors gets their returns less the fees set by the Strategy Provider.

*Example: Investor has a starting balance of $5000 and starts copying a selected strategy according to equity to equity ratio. The Strategy Provider’s performance fee for copying this strategy is 10% of Investor’s Profit. Strategy Provider makes some successful trades and Investor gets a profit of $2500 from copying their strategy. So Investor’s return will be calculated as follows: the starting balance of $5000 plus the profit of 2500 USD less 250 USD (10% fee) equals to $7250.*cTrader Copy Benefits Over PAMM