We are happy to announce that we have released cTrader 3.0 including cTrader Automate, the successor of their cAlgo platform, as an integrated part of cTrader 3.0. After two months of public beta testing, Spotware started rolling out cTrader 3.0 and cTrader Automate to brokers. cTrader 3.0 incorporates both cTrader and cAlgo which have been renamed to cTrader Trade and cTrader Automate respectively. Below you can find some of the most important features included in this release.

Merged cTrader

Now cTrader has brought together everything you need for successful trading into one application. You can trade, automate your strategies and analyze your performance from one platform! ###

More Ticks

Now you have a wide range of predefined ticks for building tick charts. You can select ticks from 1 up to 1000. ###

Improved Order Placing Design

Now placing an order is more pleasant and explicit. ###

Price Alerts Tab

Now you can quickly create and manage all price alerts using the Price Alert tab which has been introduced in the TradeWatch section. ###

Settings Panel

Now all cTrader settings have been brought together into a new Settings panel and split into appropriate sections. The settings panel is a single point to configure your cTrader preferences. ###

Analyze Application

Now you can analyze your trading performance using Analyze. It is a new analytical tool which contains key trading performance info, such as Performance Summary, Equity chart, Performance chart, Statistics on Performance, Volume, Profitability and Trading. You can quickly understand the current state of trading activities as well as to analyze performance from different perspectives and time ranges.

Market Watch Settings

Now you can find Market Watch Settings on the Market Watch section as well as in Settings panel. ###

New cTrader Login Window

New Windows native Login window for logging with cTID (cTrader ID) has been introduced. ###

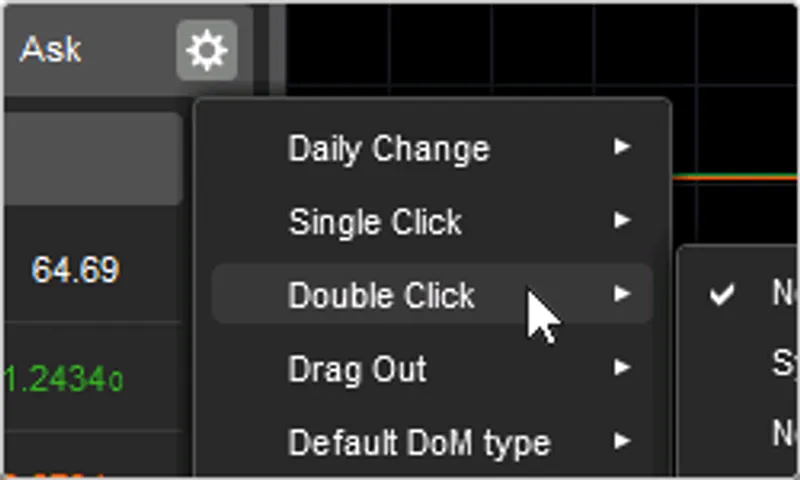

New Symbol Click Behavior Options

New click options have been added in order to make your trading experience more flexible. The symbol "Double Click" options were extended by "New Detached Chart", "Drag Out" options by "New Chart" and "New Detached Chart".

Email Confirmation

Email confirmation prevents the blocking of incoming emails by the mailing system and ensures you receive email alerts and other relevant information from the platform. You can find this feature under "Email Alerts". ###

Account Properties

You can change Account properties such as Currency, Leverage and Account type. These setting can be found in Settings panel's Properties tab. Some restrictions do apply. ###

New cAlgo.API

cAlgo API has added support for StopLimit order, Trailing Stop parameter, market hours for a symbol, new trading events and more. See the full list here: What's new in cAlgo API 3.0###

Visual Studio Extension Update.

Visual Studio Extension for cBots and Indicators was updated. Now it works with latest versions of Visual Studio.